Uncategorized

Our 2015 Annual Cost of Living in Costa Rica Summary

- By in Blog

![]() It’s time, once again, for our annual cost of living summary. Some of you will find this interesting, but others, not so much. That’s okay— Just read the section below that describes your level of interest.

It’s time, once again, for our annual cost of living summary. Some of you will find this interesting, but others, not so much. That’s okay— Just read the section below that describes your level of interest.

And, for the “I love numbers and details and I want to see it all” group:

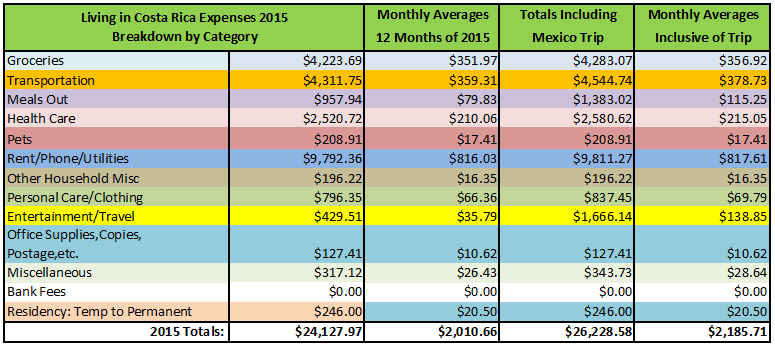

Here’s a breakdown of what we spent by category to live for the entire year in Costa Rica, as well as the monthly averages. The next two columns show what we spent (total and monthly averages) including the costs associated with our 29 day Mexico trip.

Overview

Some expense categories were not affected by our traveling; we had to pay them whether we were in Costa Rica or not:

- rent

- car-related expenses other than gasoline

- the security system for the house

- our Vonage VoIP phone

- healthcare

- pet care

- some other miscellaneous expenses

As mentioned above, the categories that were most affected by our travels are:

- groceries

- meals out

- transportation

- entertainment & travel

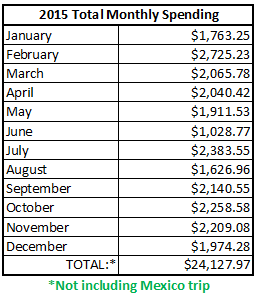

That being said, our goal is still to spend $2,000 or less each month to live in Costa Rica. If you look at the monthly averages above for just Costa Rica spending, we just about hit our target, coming in at $2010.66. But if you include our travels, we are about $175/month over that total. If you divide the total CR amount ($24,127.97) by only 10 months, it comes to $2,413/month, but using that as an average would err a bit on the high side (as we paid rent and most utilities for 12 months). Once again, we are extremely pleased with how we were able to live and travel for the money we spent.

Here’s a breakdown by month of what we spent to live in Costa Rica in 2015:

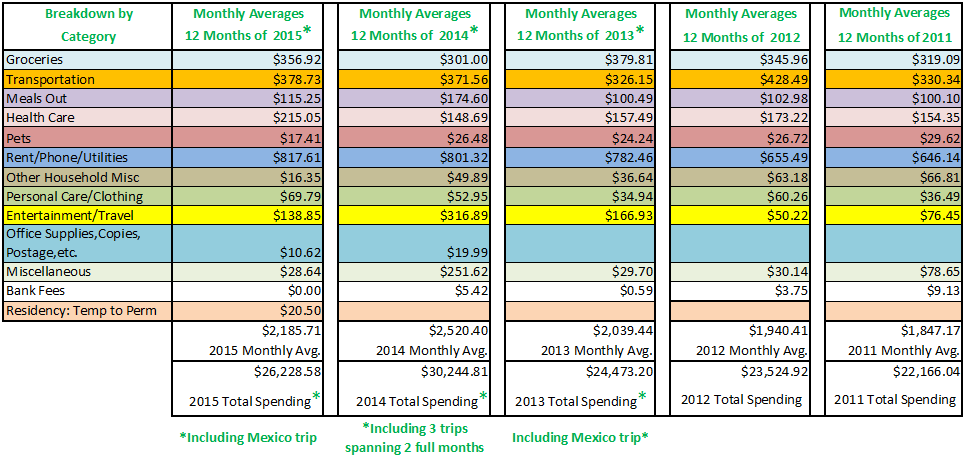

Previous Years Spending Comparison

When you look at an overview of the last five years, we can generalize by saying that we spent about $100 more per month each year over the previous year (with the exception of 2014 when we traveled internationally for 2 months of the year). In 2014, if you don’t include our international travels, our Costa Rica cost of living was $21,191.79.

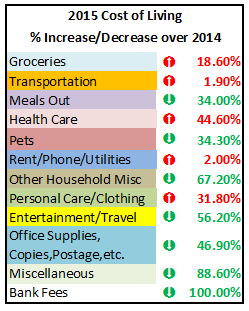

Groceries

So what did our grocery spending include? It includes almost everything – food, wine, and flowers, paper products (paper towels, toilet paper, wax paper, plastic wrap, and aluminum foil, zip lock bags, etc.), cleaning products (dish soap, laundry soap, Clorox, sponges, disinfectant, etc.), charcoal for the grill, and personal care products (bar soap, shampoo, razors, powder, etc.). All in all, not bad for $356.92.

As of January 2015, we broke out our non-food items from food items when we tally our monthly grocery spending. On average, for the year 2015, we spent about 84% on food items and 16% on non-food items as described above. A good goal for us is to decrease the percentage of spending on non-food items.

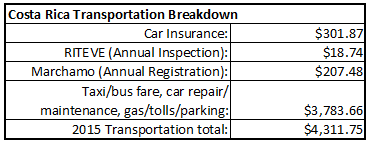

Transportation

Our Costa Rica monthly average for transportation is up by only about $7/month from 2014 spending. Note that these expenses do not include our travels out of the country.

Our Costa Rica monthly average for transportation is up by only about $7/month from 2014 spending. Note that these expenses do not include our travels out of the country.

While gas prices in Costa Rica are still higher than in some parts of the world like the U.S., the price per gallon of regular gasoline dropped significantly in 2015 (about $3.90/gallon) from 2014 (about $5.50/gallon).

Even though we have an old car, we have a reliable one, and an honest and reasonably priced mechanic. We’ve only had normal wear-and-tear maintenance and repairs on our 1996 Toyota 4-Runner, including an almost $1,000 clutch & hydraulics replacement in February.

Taxi and bus fares were minimal since we mostly use our car, but we do use public transportation at times, especially if we’re heading into San Jose for the day or when our car is in the shop.

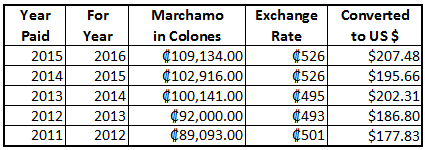

Marchamo (annual registration and mandatory insurance) is one car-related expense that continues to increase every year:

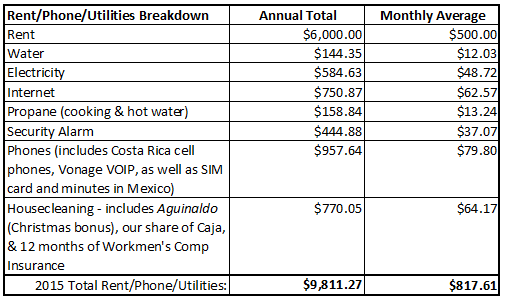

Rent, Phone, Utilities, & Housecleaning

Our electricity bill is quite low since we don’t have to pay for heat or air-conditioning. That’s one big reason we chose to live in the Central Valley. Another reason that it’s low is that we use bottled propane gas for both cooking and hot water. Just as gasoline prices went down in 2015, so did the cost of propane (from an average of $19.91 in 2014 to $13.24 in 2015). When you look at both electricity and propane, our energy costs average only $62 per month.

Our electricity bill is quite low since we don’t have to pay for heat or air-conditioning. That’s one big reason we chose to live in the Central Valley. Another reason that it’s low is that we use bottled propane gas for both cooking and hot water. Just as gasoline prices went down in 2015, so did the cost of propane (from an average of $19.91 in 2014 to $13.24 in 2015). When you look at both electricity and propane, our energy costs average only $62 per month.

We have two cell phones and a Vonage phone. With Paul’s cell phone, we have a monthly contract and, though the bill fluctuates a bit from month to month, it’s usually about $20-$25 per month. My (Gloria’s) phone has a “pay-as-you-go” sim card and it probably costs me about $3 per month—I’m not a big phone talker and mostly use my phone to check in with Paul.

Our internet service is a high-speed wireless connection through a private company. ICE, the national electric and phone company, still does not provide service in our area. If one day they do, we could probably reduce our monthly cost for Internet. Though this is one of our larger expenses, we do watch television over the Internet which eliminates the need to buy a TV and pay for cable.

W e include “housecleaning” in this category because it was included in our rent when we lived at the Cabinas, so it’s easier to compare that way. You’ll see that this included our payment of Workman’s Comp insurance, our share of our housekeeper’s monthly Caja payment, and her Christmas bonus, which is required by law. You can read an explanation of the law at this link: http://www.crlaborlaw.com/espanol/christmasbonus.htm.

e include “housecleaning” in this category because it was included in our rent when we lived at the Cabinas, so it’s easier to compare that way. You’ll see that this included our payment of Workman’s Comp insurance, our share of our housekeeper’s monthly Caja payment, and her Christmas bonus, which is required by law. You can read an explanation of the law at this link: http://www.crlaborlaw.com/espanol/christmasbonus.htm.

Healthcare

Our healthcare expenses went up by 44.6%, from an average monthly expenditure of $148.69 in 2014 to an average of 215.05 in 2015. This increase has less to do with an increase in healthcare expenses than that fact that we added some healthy supplements to our daily diet (included in this category).

I (Gloria) also had a colonoscopy which we paid for privately. Had we waited to have this test done through the Caja, there would have been a 2-3 year wait since it was a non-emergency and I hadn’t been diagnosed with anything that would warrant speeding up the process. However, we knew we could have this done privately, right in our town of San Ramón. The quoted price was 170,000 colones (about $321.00). We asked him if he offered a discount for cash and he gave us 10% off, so we ended up paying $290.00 USD, a savings of $31.00. We got the results the same day, including digital photos from the test, and thankfully, everything was normal.

We continue to use the Caja for most healthcare needs. You can read more about this in our article: “Paul’s Monthly Tip to Live for Less in Costa Rica: Join the Caja, Costa Rica’s National Medical System.”

Entertainment & Travel

The main chunk of spending in this category in 2015 was our 29 day trip to Mexico. Even so, we spent 56.2% less on “Entertainment/Travel” than in 2014 since, that year, we were traveling for two full months. One point of note is that our Mexico travel expenses do not include the cost of airfare. We were in Mexico to speak at a conference and took advantage of being there to extend our time and explore the country a bit. We spent most of the time in the town of Oaxaca (which we keep going back to every year because we love it so much).

Other than those expenses, this category includes things like book and magazine purchases, a subscription to Netflix, and an online subscription to the Baltimore Sun (our hometown newspaper) for Paul. I read a lot on my iPad and I’ve found that I can keep my costs down by taking advantage of all the free books available on Amazon. It also includes the cost of admission for parks we go to, including Playa Dona Ana for our “beach days,” museums, and cultural events, though most we take advantage of are free.

Everything Else

There’s not much to point out in the other categories:

There’s not much to point out in the other categories:

- Meals Out – We still eat lunches at “Paul’s Famous $1 Restaurant” and usually have dinner at home, except for special occasions when we eat at nice restaurants, and when we travel.

- Pets – We still have our two cats, Tori and Laura Chinchilla, so our main expenses are cat food, litter, and occasional vet visits.

- Other Household Misc – This includes things like getting appliances (stove, refrigerator, microwave, and coffee grinder) repaired, plants, light bulbs, and batteries.

- Office Supplies/Copies/Postage – This category includes our yearly post office box rental and postage, printer ink and paper, and miscellaneous office supplies.

- Personal Care/Clothing – Hair cuts and beard trims for Paul, hair cuts, color, and an occasional pedicure for Gloria, shoes, and clothes, mostly from Ropa Americana. We also purchased some clothing and personal care items from Amazon which friends brought to Costa Rica for us in their luggage. This remains the best way to bring items like vitamins and other nutritional supplements into Costa Rica.

- Miscellaneous – This and that, gifts and donations, anything that doesn’t fit elsewhere.

- Bank Fees – No more stiff ATM fees for us! We paid zero bank fees in 2015. It helped us so much to have a savings account here in Costa Rica and write checks to ourselves from our U.S. bank account.

So, all in all, 2015 was another very good year for the Yeatmans. We’re frugal, and tend to live simply. We did a lot with the money we spent, both here in Costa Rica and while traveling, and we feel really good about that. But the best things in life are the things money can’t buy — being grateful for all we have, being with and caring for those we love, and enjoying this beautiful country that we call home. Pura vida!

Related Articles:

- Our 2014 Cost of Living Summary

- Our 2013 Cost of Living Summary

- Our 2012 Cost of Living Summary

- Our Costa Rica Food Budget Breakdown

- Paul’s Monthly Tip to Live for Less in Costa Rica: Join the Caja, Costa Rica’s National Medical System

- Paul’s Monthly Tip to Live for Less in Costa Rica: Save on Car Repairs

- Paul’s Monthly Tip to Live for Less in Costa Rica: Sign Up for Skype, Vonage, or Magicjack

- Paul’s Monthly Tip to Live for Less in Costa Rica: Vacation the Retire for Less Way!

- Paul’s Monthly Tip to Live for Less in Costa Rica: Save on Telephone Service