Life in CR, Why Retire in CR?

Retire for Less in Costa Rica – June 1, 2017

Welcome to our Retire For Less In Costa Rica Newsletter

In This Special Healthcare Issue:

- Jackson’s Care – A Cost Effective Option for Private Healthcare in Costa Rica

- In the Mailbag – Medicare and Health Insurance

- Our Ultimate CR Healthcare Tour

Jackson’s Care – A Cost Effective Option for Private Healthcare in Costa Rica

In addition to MediSmart, Hospital Metropolitano’s discount healthcare plan, there is now another option. Jackson’s Care is a brand new plan offered by Jackson Memorial Medical Center. We have been meeting with them over the last two months to understand and document the plan in English for our readers.

Jackson’s Care provides a cost effective alternative to healthcare for you and your family in Costa Rica. It is a preventative health plan, a “wellness plan,” and is designed to give you the best prices for doctor’s visits, blood work, and other diagnostic tests. In the plan, you are encouraged to get a full medical baseline by meeting with a primary care physician on a regular basis, seeing specialists when needed, and having all appropriate diagnostic tests.

Jackson’s Care provides a cost effective alternative to healthcare for you and your family in Costa Rica. It is a preventative health plan, a “wellness plan,” and is designed to give you the best prices for doctor’s visits, blood work, and other diagnostic tests. In the plan, you are encouraged to get a full medical baseline by meeting with a primary care physician on a regular basis, seeing specialists when needed, and having all appropriate diagnostic tests.

What services does the Jackson’s Care plan include?

Services provided:

- General practitioners

- Medical specialists in:Nutrition

- Cardiology

- Dermatology

- Surgery

- Gynecology

- Ophthalmology

- Pediatrics

- Urology

- Orthopedics

- Otorhinolaryngology

- Internal Medicine

- Family Medicine

- Geriatrics (applicable only with the Gold Plan

- Laboratory (blood work)

- X-Rays & Ultrasounds

How does the Jackson’s Care plan work?

When you join the Jackson’s Care Plan, you can start using the services as of the date indicated on your membership card. Just call the Redbridge Call Center at (+506) 2520-0210, 24 hours a day/7 days a week, or email them at [email protected]. They will schedule your appointments with their affiliates and manage your health care needs and treatment.

Their service promotes health education, awareness, and understanding, as well as better utilization of health services. They require that your first appointment is with a general practitioner; then they will make other medical appointments for you as necessary.

What is covered under the various Jackson’s Care plans and for which plan do I qualify?

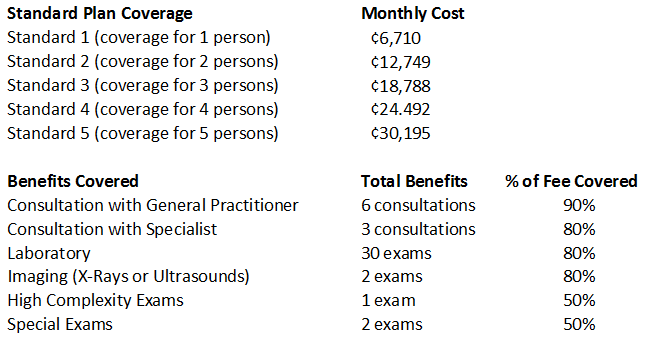

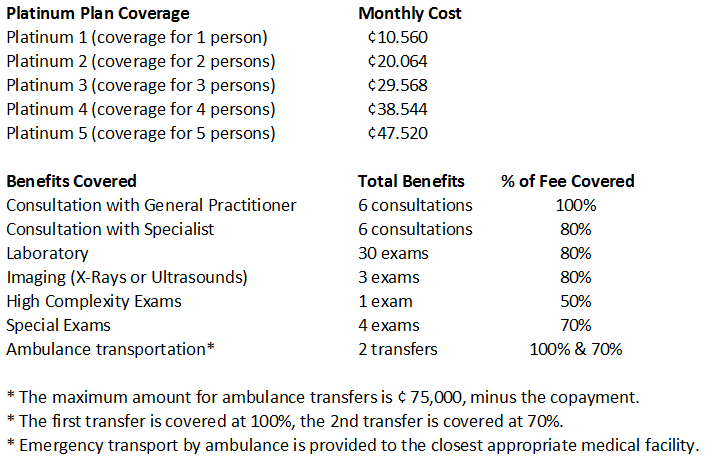

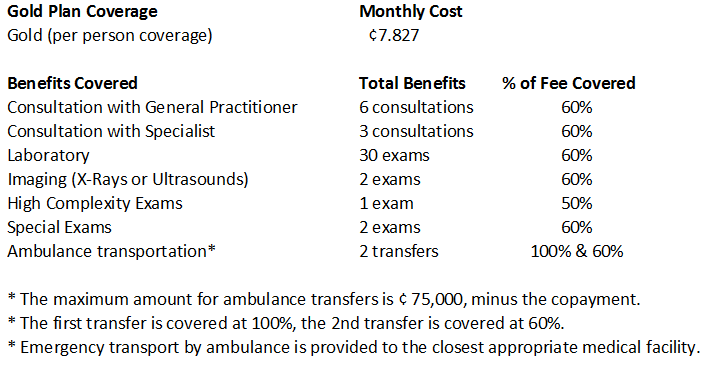

Note: For each of the following plans, the benefit totals listed in each category are per person and per year.

STANDARD AMBULATORY MEDICAL CARE PLAN

(For people between the ages of 1 and 58 years, 364 days)

PLATINUM OUTPATIENT HEALTH CARE PLAN

(For people between the ages of 1 and 58 years, 364 days)

GOLD OUTPATIENT MEDICAL CARE PLAN

(For people between the ages of 59 and 84 years, 364 days)

What are some examples of “High Complexity Exams?”

- Colonoscopy

- Gastroscopy

- Bone density scan

- Pelvic endovaginal ultrasound

- Prostate and Urinary tract ultrasound

What are some examples of “Special Exams?”

- Electrocardiogram

- Hepatitis antibody test

- Testosterone levels (free and total)

- Vitamin B-12 levels

- Cortisol levels (blood or urine)

Where can I use my Jackson’s Care plan?

You can use your plan at hospitals, medical center, and labs all over Costa Rica. Here are a few examples:

San Jose area

- Hospital Metropolitano

- ServiSalud

- Hospital Cristiano Jerusalén

- Hospital La Católica

- Clínica UNIBE

- Hospital Metropolitano Tibás

- Clínica El Labrador

- Clínica de Urgencias PZ

- Plaza Medica

Escazú

- Blue Medical

Alajuela

- Clínica San Miguel

- Clínica Peña

Naranjo

- Clínica de Especialidades Medicas San Gerardo

San Ramón

- Centro Medico Jackson Memorial

San Carlos

- Hospital Cooperativo ConSalud

Heredia

- Centro Clínico Orozco

- Centro Medico San Joaquín

Liberia

- Hospital Centro Medico San Rafael Arcángel

- Clínica Integral Santa Cruz

- Hospital Metropolitano Cabo Velas

Limón

- Clínica Medica Walters y Chavarría

Cartago

- Clínica Universal de Cartago

- Clínica Señora de los Ángeles

Turrialba

- Centro Medico Laxmi

To receive a full list of affiliated providers and the services available at each, just call the Redbridge Call Center at (+506) 2520-0210, 24 hours a day/7 days a week, or email them at [email protected].

What will my out-of-pocket cost be to use the plan?

Since most readers of Retire for Less in Costa Rica are at or near retirement age, we will use the “Gold Outpatient Medical Care Plan” for the cost breakdown.

The monthly cost of the Gold Plan is 7,827 colones per month (about $13.65 per month at the current exchange rate of 574 colones to the dollar). Therefore, enrollment in the plan per person for the mandatory 12 months would be 93,924 colones (about $169).

In general, the base rate for an appointment with a general practitioner is around $50, and the base rate for a specialist is around $90. Your out-of-pocket fee will be that amount minus the percentage of discount provided in your plan. So, if you are 59 years of age or older, you would pay the following:

- General Practitioner: $50 minus 60% discount, or $20

- Specialist: $90, minus 60% discount, or $36

Each individual provider of medical services sets their own fees, so your actual base fee may vary. You will pay each medical provider directly at the discounted rate.

One important thing to note is that each time you have a medical issue, you will first need to see your primary care doctor before making an appointment with a specialist. This allows the primary care doctor to better manage your care and eliminate the extra cost of seeing a specialist unnecessarily. Should you want to see a specialist without seeing a primary care doctor first, you have the option to do that outside of the plan. Jackson Memorial Medical Center allows plan members to see the specialists at their clinic in San Ramon de Alajuela at a discounted rate of 10% off the regular prices and 20% off laboratory testing. (Other local clinics may also offer off out-of-plan discounts but you would need to check with each clinic individually.)

After all of your plan benefits have been used for the year, Jackson Memorial Medical Center allows plan members to obtain services at their clinic in San Ramon de Alajuela at a discounted rate of 10% off the regular prices, with 20% off laboratory testing.

How can I pay for the Plan?

Monthly Payment through Debit of your Costa Rica Bank Account (Any Bank in Costa Rica)

Since you need to be a legal resident to have a bank account in Costa Rica, this option would only apply to legal residents.

- Set up authorization for automatic debits to bank accounts, on the customer’s choice of day

- Payment of monthly fee through direct debit

- Waiting time for use: 7 days

- First deduction according to the date of acquisition

Annual Payment at Coopenae Cooperativa

Since no Costa Rica bank account is required, anyone can use this option. You do not need to be a legal resident or have an account at Coopenae. You can pay for the plan at any Coopenae branch after first completing all required paperwork to enroll in the Jackson’s Care Plan.

- By pre-payment to Coopenae of the entire contract amount

- Annualized payment for 12 months of the plan

- Waiting time for use: 7 days

Note: Coopenae is a Costa Rica cooperativa (credit union) and a partner in offering the Jackson’s Care plan.

Payroll Deduction through Coopenae

Since the great majority of our readers are not salaried employees in Costa Rica, this option would not apply to most. However, in case someone reading this is employed in Costa Rica, we opted to include the following information:

- Payment of monthly fee through payroll deduction

- Waiting time for use: 7 days

- Coopenae uses the payroll deduction system through agreements already established with institutions, which determine the how often the deductions are made (weekly, biweekly, monthly, etc.)

The effective date of your plan begins after the 7 day waiting period.

Does Jackson’s Care Plan make sense for me if I am a “snowbird?”

You will have to make this determination for yourself. While you can suspend your year’s contract in the plan with 30 days notice, there is a penalty of approximately $40. So, as an example, for someone over age 59 who is only in Costa Rica for five months of the year, the actual plan costs would be as follows:

Five month’s plan membership: 7,827 colones x 5 = 39,135 (about $68.18)

Contract suspension penalty: $40

Actual monthly cost of the plan for this person: $118.18 divided by 5, or $21.64 per month

In the end, whether or not the Jackson’s Care plan is right for you is your decision. It may be a particularly good option for people living outside of the Central Valley, in Perez Zeledon, Liberia, or San Carlos, for instance. Our goal in providing you with this information is to give you options for medical care in Costa Rica, whether you live here full time or for part of the year.

Related Articles:

- MediSmart: An Affordable Alternative to Private Health Insurance in Costa Rica

- Costa Rica’s Caja: How it Works

In the Mailbag – Medicare and Health Insurance

We always get lots of responses and questions from readers, both newsletter subscribers and on Facebook. This month’s questions dealt with Medicare (U.S. citizens) and health insurance.

We always get lots of responses and questions from readers, both newsletter subscribers and on Facebook. This month’s questions dealt with Medicare (U.S. citizens) and health insurance.

Mark N. wrote,

I notice in your budget and in other representative budgets on your web site (the woman living for ~ $1200 per month) there is no deduction from social security for monthly Medicare payments. I was under the impression that once one hits 65, Social Security automatically deducts somewhere on the order of $134 per month for Medicare Part B premiums. Could you please discuss this – I’m not yet that age, but approaching it so would like to hear how people deal with this: i.e. purchase Costa Rica health insurance(s) and keep Medicare as a backup, or if not then opt out of Medicare (am not sure if that’s even possible or if so, how?). Thanks for all your useful information.

Great question, Mark. When you reach retirement age,you will have the option to have Medicare B deducted from your Social Security or to opt out. If you opt out and later decide you want Medicare B coverage, they charge you a monthly penalty.

- https://retireforlessincostarica.com/medismart-an-affordable-alternative-to-private-health-insurance-in-costa-rica/

- https://retireforlessincostarica.com/in-the-mailbag-a-readers-experience-with-medismart-january-2017/

- https://retireforlessincostarica.com/our-2016-costa-rica-healthcare-plan-by-rob-evans/

Hi Rob,

I’ve found your articles on finding health insurance so helpful as our family prepares for a sabatical year in Costa Rica, beginning in June. I’m a little late in sorting out insurance and I’ve been in touch with Perfect Circle and am inclining towards a WEA plan combined with BUPA, but something is getting lost in the translation as I try to get info from Perfect Circle about how claims are processed. My question is: Do in-network outpatient provider claims get filed directly with WEA from provider or am I required to pay the medical provider first and then file a claim for reimbursement? I’m hoping you can clear this up for me. Thanks so much for your help and this website has been so useful!

Here is Rob’s answer to Megan:

I have used them for a year and never been sick but I will tell you how it worked for me. I have a $2500 deductible so probably and hopefully will never need insurance. When I do go to the doctor, I have to collect the invoice, the receipt showing I paid, and the report from the doctor on what he did.

Claims need to be submitted in 90 days. I can either drop the papers off at the Perfect Circle (PC) office, or they will send a messenger to collect them, or I can take a picture with my phone and email them.

PC organizes the papers, translates them and figures the exchange rate and submits them for me. I can do all that myself but I am lazy and love being pampered. PC also calls the doctor to get more info if needed which I love since me Spanish is terrible.

I also get pre-certified for anything to make sure things go smoothly. I can see all my claims online and could do all this myself if I wanted but PC does it so much better. I like knowing that if I move to Europe, I can do it myself though I could still email the information to PC too.

I understand if bad things happen, I could either pay myself and submit the bills or call PC or WEA and they would work out a direct pay with the hospital. WEA sent me a list of preferred hospitals they already have a relationship with which includes all the major ones in Costa Rica so no worries. I like that PC is local, speaks Spanish and would be my advocate with the hospital and WEA. In network/ out of network only applies if you choose care in the US.

Regarding your question, “Can you use Medismart discount plan and then submit those claims to WEA to work towards the deductible?” Yes, do it all the time. Medismart is like Cosco , a discount provider. So, when I see my primary doctor it costs $15 which I submit. My annual Dermotologist checkup is only $30. With those low prices, it is unlikely I will ever get over my $2500 deductible.

Claire also had a question about the WEA plan:

I read your article on your 2016 insurance plan and have been looking into the WEA plan. My husband and I plan to be living in CR 6 months a year and 6 months in the US. We will have permanent residency in CR and are both US citizens…We are curious about how the WEA plan has worked for you so far. I have not been able to find any customer reviews on line. Any feedback you can offer will be appreciated. Thanks.

Rob replied,

WEA offers expat policies that you can use worldwide which was what I wanted. With that feature, we can travel and live anywhere without applying for new coverage in each country when we move.

In addition, WEA offers the option to exclude care in the US which halves the cost. So, our cost went from $3600/yr/couple to $1800/yr/couple by excluding the US. Given I can get care in every country in the world except the US seems like a reasonable risk for the cost benefit.

At this point, it depend on what you want. The problem you will have is that splitting your time between the US and CR means you are subject to Obamacare. Obamacare exclusion requires you live outside the US for 330 days a year. WEA policy does not qualify for Obamacare exclusion so you will need US coverage too or pay a penalty.

An option would be to get WEA without US coverage and buy a US policy too. That could be very expensive. $1800/yr/couple for CR and $13,000/yr/couple for the US. If you have Medicare or Tricare, you are lucky and covered in the US. Given you are required to get US coverage since you are in the US six months of the year, you should look into trip insurance while in CR as a less expensive option than WEA. Note trip insurance will just stabilize you until you can get back to the US and use your US policy.

I am writing up my observation now on my first year with WEA. I am pleased with the value. Since moving to CR we have gotten much healthier and need little medical attention so I am happy to to have affordable insurance I hope I will never use.

Stay tuned, everyone, for Rob’s update!

Related Articles:

- Our 2016 Costa Rica Healthcare Plan, by Rob Evans

- MediSmart: An Affordable Alternative to Private Health Insurance in Costa Rica

- Read all of our “In the Mailbag” columns at this link.

![]()

Our Ultimate CR Healthcare Tour

We are proud to offer the Ultimate Healthcare Tour of Costa Rica. When asked what he liked best about our healthcare tour, one of our guests wrote, “the wide variety of places we saw, the experts that Paul  arranged for us to meet and talk with, and an emphasis on all aspects of health, not just doctors and hospitals. Mental health is just as important as physical, if not more so.”

arranged for us to meet and talk with, and an emphasis on all aspects of health, not just doctors and hospitals. Mental health is just as important as physical, if not more so.”

We’ve lived in Costa Rica for over eight years and have used the Caja, Costa Rica’s public healthcare system extensively, as well as the private system, when needed. We’ve learned the system and have been referred up the ladder to see specialists in the maze that is the Caja system. Gloria’s even had surgery here.

Our blend of personal insights and on-the-ground experience combines to answer your questions about whether or not Costa Rica’s healthcare system could meet your individual needs.

But, while it is focused on healthcare, you will learn a lot more about living and retiring in Costa Rica’s Central Valley. Most of the second day of the tour takes place in the town of San Ramón where we live and use the services. And you will come to our home for lunch that day to listen to two presentations.

Our tour is designed to save you both time and money, packing a lot of information into a short period of time. Our goal is to show you the possibilities and to try to demystify Costa Rica’s healthcare system. Our tour lasts two days and 1 night and includes lodging, transportation, meals and non-alcoholic beverages.

Sample Itinerary

You’ll visit:

- At least two private hospitals in San Jose area

- Hospital Mexico, the largest and best public hospital (they even do open heart surgeries there)

- An insurance broker for a presentation on the various supplemental health insurance options, including public, private, and international plans

- A senior living retirement community

- CPI language school for a presentation about how learning Spanish increases your options for healthcare and some basic medical Spanish.

- Our local hospital here in San Ramón

- A local EBAIS (community clinic)

- The office of our dentist in San Ramón

- A local Seguro Social office where you would sign up for the Caja (national healthcare coverage)

- A pharmacy

- A local feria (farmer’s market) where you will see the abundance of fresh food available.

- The local Cruz Roja (Red Cross) to learn about their services and programs.

- A health food store (macrobiotica), and more!

You’ll learn:

- If the Costa Rican healthcare system could meet your needs and put your mind to rest, once and for all, about this sensitive subject.

- About the public system and how it works, about the private healthcare system, and how you can use a combination of both to your advantage.

- About the EBAIS – where healthcare starts in Costa Rica.

- Approximately how much you would pay for Caja.

- About medical tourism in Costa Rica.

- About home health care in Costa Rica.

Prices: $650 for a couple, $550 for a single.

Please contact us if you are interested in booking a tour. Space is limited.

Related Articles:

- Paul Gets a CAT Scan Through the Caja

- Integration 102 – Speaking Up at the Hospital

- Waiting to See the Doctor, by Jo Stuart

Facebook, Twitter, & YouTube

Facebook, Twitter, & YouTube

![]()

![]()

![]() You can now follow us on Facebook and Twitter, so please “like” us on Facebook, “follow” us on Twitter, and watch and share our videos on YouTube.

You can now follow us on Facebook and Twitter, so please “like” us on Facebook, “follow” us on Twitter, and watch and share our videos on YouTube.

What’s New on the Website

What’s New on the Website

Check out our newest posts on www.retireforlessincostarica.com:

- Our April 2017 Costa Rica Cost of Living

- Paul’s Money Saving Tip: Find Reasonable Housing

- In the Mailbag – Tracking Living Expenses, Grocery Expense Breakdown, and “Being Gringoed”

- Our 2016 Annual Cost of Living in Costa Rica Summary

- In the Mailbag – April 16, 2017

- Renewing Our Costa Rica Drivers Licenses: A Time-Saving Tip

- Our March 2017 Costa Rica Cost of Living

- In the Mailbag – Vonage, and Getting an Emergency U.S. Passport

- Con Mucho Gusto: The Tico Way