Why Retire in CR?

So What Would It Cost ME to Live in Costa Rica?

- By in Blog

Updated 06/08/2016

So, what would it cost YOU to live in Costa Rica? Well, the realistic and safe answer is, “it all depends on you, on your lifestyle and how you want to live.” People have asked us the question, “Can we live on $3,000-$4,000 per month?” In response, Gloria and I look at each other, chuckle, and say, “Of course you can.”

So, what would it cost YOU to live in Costa Rica? Well, the realistic and safe answer is, “it all depends on you, on your lifestyle and how you want to live.” People have asked us the question, “Can we live on $3,000-$4,000 per month?” In response, Gloria and I look at each other, chuckle, and say, “Of course you can.”

Again, it all depends on how you choose to live. We manage to save over 40% of our U.S. monthly budget and we think we live pretty well. If we followed more of our own tips, we could possibly further reduce our expenditures. Our goal is to live on less than $2,000 per month, and that has been achievable, though we admit, it’s getting harder.

But if you want to live in an expensive home (either a rental or to purchase) and shop exclusively in the “American” stores (Auto Mercado and PriceSmart), it can actually cost you more than in the U.S. If you purchase an expensive car and are looking to live in luxury, then that $3,000 target may not be achievable.

First, let’s look at our previous “big three” monthly expenses:

- Healthcare was over $1,000, now $215/month

- Rent or mortgage was $1260, now $500/month

- Heat and air-conditioning was $250, now $0/month, with an average electric bill of $49/month

Other areas of savings for us include:

- Groceries

- Eating out

- Telephone

- Car insurance

- Transportation

- Clothing

- Entertainment

- Pet care

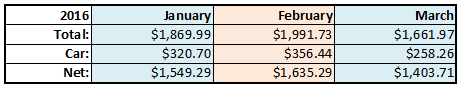

Look at our budget totals for the first three months of 2016. You can see that our car expenses are a big chunk of our monthly living expenses. If you choose not to buy a car, and take public transportation instead, think about how much you could save.

Often people will say they wouldn’t want to do that, you HAVE to have a car. It’s just not true. I know more than a few people who don’t have cars. It simplifies their lives greatly and saves them money. They walk, take buses and taxis. It’s the one thing you can do to easily simplify your life and cut expenses. Granted, without a car, you will be limited to some degree. But remember, without a car, you’ll do less, ergo spend less. You can always try going without a car for six months and buy a car later if you so desire.

Another way to keep your budget down is to rent a house or apartment for $300-$700 per month. An expat couple we know moved into in a small two bedroom apartment in town. It’s unfurnished, clean but cute, and they are paying $300/month rent, plus utilities. Since they live right in the town of San Ramon, and don’t own a car, their transportation costs are about $20/month. They walk a lot, take buses and taxis. Living in town, they are also immersed in the culture, have a lot of Tico friends, and speak a lot of Spanish which helps them to learn the language. They may not have that big view that we expats like, but everything’s a trade-off.

It’s not just about saving money. It’s that fact that when you own less, and need less, life is more simple and stress free. It’s all about your choices.