Cost of Living

Our Annual Cost of Living in Costa Rica Issue for 2015

Welcome to our Retire For Less In Costa Rica Newsletter

In This Issue:

- Our 2015 Annual Cost of Living in Costa Rica Summary

- Inflation in Costa Rica

- So What Would It Cost YOU to Live in Costa Rica?

- The Best Way to Live for Less in Costa Rica (or Anywhere)

- A Single Woman’s Budget in Costa Rica: How She Lives on $1260 USD

- Why the Higher Cost of Living in Costa Rica Is Worth It

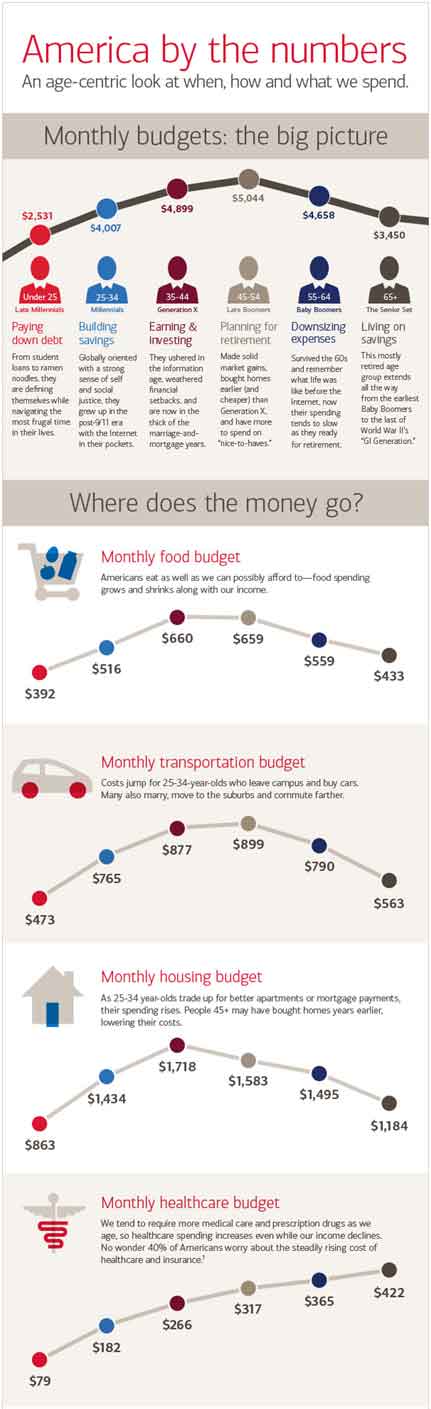

- When, How, and What People Spend in the U.S.A.

- Our Ultimate CR Healthcare Tour: Announcing a Special Tour with Focus on Cancer Treatments in Costa Rica

Our 2015 Annual Cost of Living in Costa Rica Summary

It’s time, once again, for our annual cost of living summary. Some of you will find this interesting, but others, not so much. That’s okay— Just read the section below that describes your level of interest.

And, for the “I love numbers and details and I want to see it all” group:

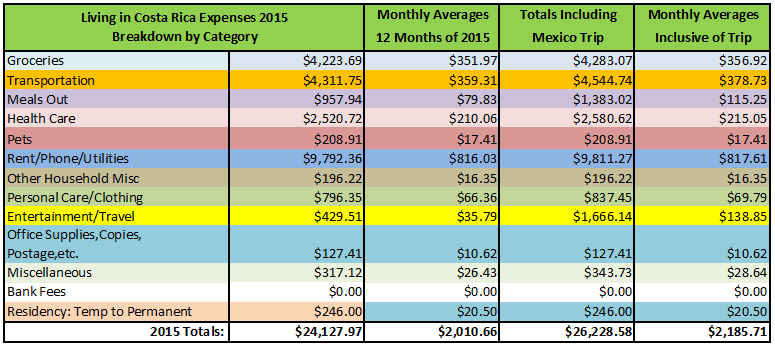

Here’s a breakdown of what we spent by category to live for the entire year in Costa Rica, as well as the monthly averages. The next two columns show what we spent (total and monthly averages) including the costs associated with our 29 day Mexico trip.

Overview

Some expense categories were not affected by our traveling; we had to pay them whether we were in Costa Rica or not:

- rent

- car-related expenses other than gasoline

- the security system for the house

- our Vonage VoIP phone

- healthcare

- pet care

- some other miscellaneous expenses

As mentioned above, the categories that were most affected by our travels are:

- groceries

- meals out

- transportation

- entertainment & travel

That being said, our goal is still to spend $2,000 or less each month to live in Costa Rica. If you look at the monthly averages above for just Costa Rica spending, we just about hit our target, coming in at $2010.66. But if you include our travels, we are about $175/month over that total. If you divide the total CR amount ($24,127.97) by only 10 months, it comes to $2,413/month, but using that as an average would err a bit on the high side (as we paid rent and most utilities for 12 months). Once again, we are extremely pleased with how we were able to live and travel for the money we spent.

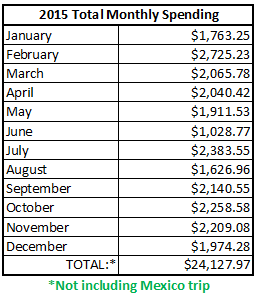

Here’s a breakdown by month of what we spent to live in Costa Rica in 2015:

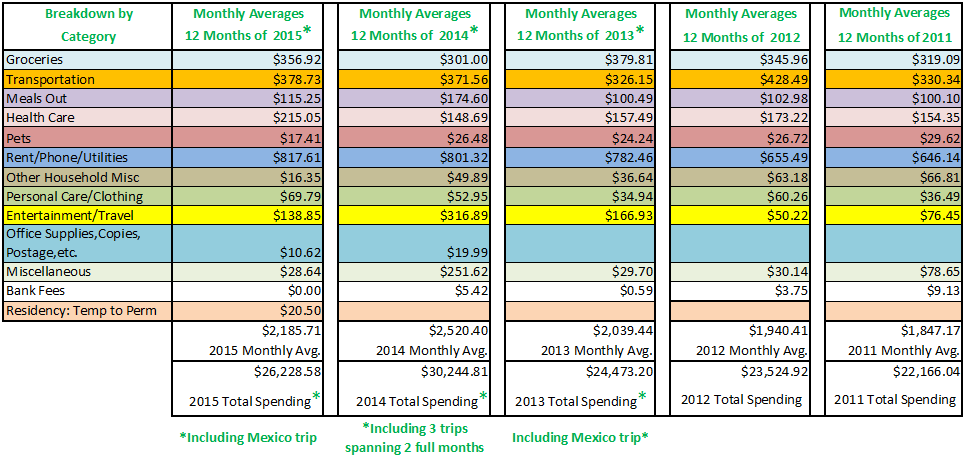

Previous Years Spending Comparison

When you look at an overview of the last five years, we can generalize by saying that we spent about $100 more per month each year over the previous year (with the exception of 2014 when we traveled internationally for 2 months of the year). In 2014, if you don’t include our international travels, our Costa Rica cost of living was $21,191.79.

Groceries

So what did our grocery spending include? It includes almost everything – food, wine, and flowers, paper products (paper towels, toilet paper, wax paper, plastic wrap, and aluminum foil, zip lock bags, etc.), cleaning products (dish soap, laundry soap, Clorox, sponges, disinfectant, etc.), charcoal for the grill, and personal care products (bar soap, shampoo, razors, powder, etc.). All in all, not bad for $356.92.

As of January 2015, we broke out our non-food items from food items when we tally our monthly grocery spending. On average, for the year 2015, we spent about 84% on food items and 16% on non-food items as described above. A good goal for us is to decrease the percentage of spending on non-food items.

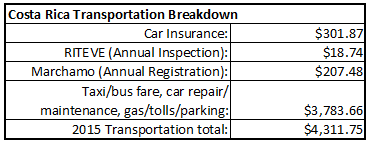

Transportation

Our Costa Rica monthly average for transportation is up by only about $7/month from 2014 spending. Note that these expenses do not include our travels out of the country.

Our Costa Rica monthly average for transportation is up by only about $7/month from 2014 spending. Note that these expenses do not include our travels out of the country.

While gas prices in Costa Rica are still higher than in some parts of the world like the U.S., the price per gallon of regular gasoline dropped significantly in 2015 (about $3.90/gallon) from 2014 (about $5.50/gallon).

Even though we have an old car, we have a reliable one, and an honest and reasonably priced mechanic. We’ve only had normal wear-and-tear maintenance and repairs on our 1996 Toyota 4-Runner, including an almost $1,000 clutch & hydraulics replacement in February.

Taxi and bus fares were minimal since we mostly use our car, but we do use public transportation at times, especially if we’re heading into San Jose for the day or when our car is in the shop.

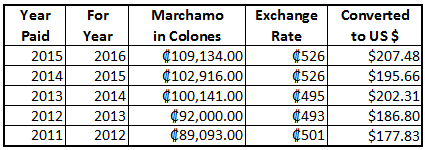

Marchamo (annual registration and mandatory insurance) is one car-related expense that continues to increase every year:

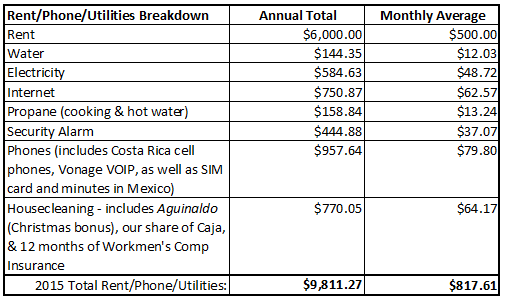

Rent, Phone, Utilities, & Housecleaning

Our electricity bill is quite low since we don’t have to pay for heat or air-conditioning. That’s one big reason we chose to live in the Central Valley. Another reason that it’s low is that we use bottled propane gas for both cooking and hot water. Just as gasoline prices went down in 2015, so did the cost of propane (from an average of $19.91 in 2014 to $13.24 in 2015). When you look at both electricity and propane, our energy costs average only $62 per month.

Our electricity bill is quite low since we don’t have to pay for heat or air-conditioning. That’s one big reason we chose to live in the Central Valley. Another reason that it’s low is that we use bottled propane gas for both cooking and hot water. Just as gasoline prices went down in 2015, so did the cost of propane (from an average of $19.91 in 2014 to $13.24 in 2015). When you look at both electricity and propane, our energy costs average only $62 per month.

We have two cell phones and a Vonage phone. With Paul’s cell phone, we have a monthly contract and, though the bill fluctuates a bit from month to month, it’s usually about $20-$25 per month. My (Gloria’s) phone has a “pay-as-you-go” sim card and it probably costs me about $3 per month—I’m not a big phone talker and mostly use my phone to check in with Paul.

Our internet service is a high-speed wireless connection through a private company. ICE, the national electric and phone company, still does not provide service in our area. If one day they do, we could probably reduce our monthly cost for Internet. Though this is one of our larger expenses, we do watch television over the Internet which eliminates the need to buy a TV and pay for cable.

W e include “housecleaning” in this category because it was included in our rent when we lived at the Cabinas, so it’s easier to compare that way. You’ll see that this included our payment of Workman’s Comp insurance, our share of our housekeeper’s monthly Caja payment, and her Christmas bonus, which is required by law. You can read an explanation of the law at this link: http://www.crlaborlaw.com/espanol/christmasbonus.htm.

e include “housecleaning” in this category because it was included in our rent when we lived at the Cabinas, so it’s easier to compare that way. You’ll see that this included our payment of Workman’s Comp insurance, our share of our housekeeper’s monthly Caja payment, and her Christmas bonus, which is required by law. You can read an explanation of the law at this link: http://www.crlaborlaw.com/espanol/christmasbonus.htm.

Healthcare

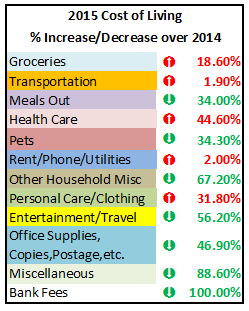

Our healthcare expenses went up by 44.6%, from an average monthly expenditure of $148.69 in 2014 to an average of 215.05 in 2015. This increase has less to do with an increase in healthcare expenses than that fact that we added some healthy supplements to our daily diet (included in this category).

I (Gloria) also had a colonoscopy which we paid for privately. Had we waited to have this test done through the Caja, there would have been a 2-3 year wait since it was a non-emergency and I hadn’t been diagnosed with anything that would warrant speeding up the process. However, we knew we could have this done privately, right in our town of San Ramón. The quoted price was 170,000 colones (about $321.00). We asked him if he offered a discount for cash and he gave us 10% off, so we ended up paying $290.00 USD, a savings of $31.00. We got the results the same day, including digital photos from the test, and thankfully, everything was normal.

We continue to use the Caja for most healthcare needs. You can read more about this in our article: “Paul’s Monthly Tip to Live for Less in Costa Rica: Join the Caja, Costa Rica’s National Medical System.”

Entertainment & Travel

The main chunk of spending in this category in 2015 was our 29 day trip to Mexico. Even so, we spent 56.2% less on “Entertainment/Travel” than in 2014 since, that year, we were traveling for two full months. One point of note is that our Mexico travel expenses do not include the cost of airfare. We were in Mexico to speak at a conference and took advantage of being there to extend our time and explore the country a bit. We spent most of the time in the town of Oaxaca (which we keep going back to every year because we love it so much).

Other than those expenses, this category includes things like book and magazine purchases, a subscription to Netflix, and an online subscription to the Baltimore Sun (our hometown newspaper) for Paul. I read a lot on my iPad and I’ve found that I can keep my costs down by taking advantage of all the free books available on Amazon. It also includes the cost of admission for parks we go to, including Playa Dona Ana for our “beach days,” museums, and cultural events, though most we take advantage of are free.

Everything Else

There’s not much to point out in the other categories:

There’s not much to point out in the other categories:

- Meals Out – We still eat lunches at “Paul’s Famous $1 Restaurant” and usually have dinner at home, except for special occasions when we eat at nice restaurants, and when we travel.

- Pets – We still have our two cats, Tori and Laura Chinchilla, so our main expenses are cat food, litter, and occasional vet visits.

- Other Household Misc – This includes things like getting appliances (stove, refrigerator, microwave, and coffee grinder) repaired, plants, light bulbs, and batteries.

- Office Supplies/Copies/Postage – This category includes our yearly post office box rental and postage, printer ink and paper, and miscellaneous office supplies.

- Personal Care/Clothing – Hair cuts and beard trims for Paul, hair cuts, color, and an occasional pedicure for Gloria, shoes, and clothes, mostly from Ropa Americana. We also purchased some clothing and personal care items from Amazon which friends brought to Costa Rica for us in their luggage. This remains the best way to bring items like vitamins and other nutritional supplements into Costa Rica.

- Miscellaneous – This and that, gifts and donations, anything that doesn’t fit elsewhere.

- Bank Fees – No more stiff ATM fees for us! We paid zero bank fees in 2015. It helped us so much to have a savings account here in Costa Rica and write checks to ourselves from our U.S. bank account.

So, all in all, 2015 was another very good year for the Yeatmans. We’re frugal, and tend to live simply. We did a lot with the money we spent, both here in Costa Rica and while traveling, and we feel really good about that. But the best things in life are the things money can’t buy — being grateful for all we have, being with and caring for those we love, and enjoying this beautiful country that we call home. Pura vida!

Related Articles:

- Our 2014 Cost of Living Summary

- Our 2013 Cost of Living Summary

- Our 2012 Cost of Living Summary

- Our Costa Rica Food Budget Breakdown

- Paul’s Monthly Tip to Live for Less in Costa Rica: Join the Caja, Costa Rica’s National Medical System

- Paul’s Monthly Tip to Live for Less in Costa Rica: Save on Car Repairs

- Paul’s Monthly Tip to Live for Less in Costa Rica: Sign Up for Skype, Vonage, or Magicjack

- Paul’s Monthly Tip to Live for Less in Costa Rica: Vacation the Retire for Less Way!

- Paul’s Monthly Tip to Live for Less in Costa Rica: Save on Telephone Service

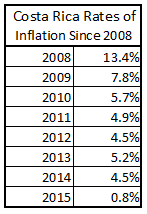

Inflation in Costa Rica

Latin America has a reputation of having high inflation. All in all, I would say that’s an accurate assumption. So let’s take a historical look at Costa Rica’s inflation since 1990.

Previous to the year 2009, inflation in Costa Rica was very high, with some years over 20% (see the graph below).

Costa Rica Inflation Chart

Source: https://www.focus-economics.com/country-indicator/costa-rica/inflation

But since we moved to Costa Rica in 2009, the country has kept inflation under control.

So how did inflation affect our cost of living? Although our cost of living in Costa Rica has gone up every year, we haven’t let inflation affect us. We just assume costs are going up about 5% and don’t pay any attention to it, until 2015, when the inflation rate was less than 1%. It’s been a good thing. For instance, the price of gas went down considerably in 2015, to as low as $3.90 a gallon (although in 2016 it’s risen to over $4.25/gallon). I drive about 9,000 miles per year, which is more than most, and a lot for someone living in Costa Rica.

Over the years, the greatest uptick in our costs was not caused by inflation, but rather by ourselves. We’ve gradually loosened our purse-strings and spent money a little more easily as our financial position has improved. In light of a 0.8% inflation rate last year, one would think our 2014 to 2015 expenses would be about the same, but like other years, our expenses went up. If you look at our Costa Rica living expenses for the last two years (not including the costs of our travels to other countries), you will see that we spent almost $3,000 more in 2015 than in 2014. This is significantly greater than the less-than-1% inflation rate for 2015.

Over the years, the greatest uptick in our costs was not caused by inflation, but rather by ourselves. We’ve gradually loosened our purse-strings and spent money a little more easily as our financial position has improved. In light of a 0.8% inflation rate last year, one would think our 2014 to 2015 expenses would be about the same, but like other years, our expenses went up. If you look at our Costa Rica living expenses for the last two years (not including the costs of our travels to other countries), you will see that we spent almost $3,000 more in 2015 than in 2014. This is significantly greater than the less-than-1% inflation rate for 2015.

- 2014 not including trips = 21,191.79

- 2015 not including trips = 24,127.97 (an increase of 14%)

Six or seven years ago, we were more frugal and cautious about our spending, but today we are likely to buy more freely and just flip the item in our shopping cart. Luckily, Gloria and I are on the same page about money. We both tend to be frugal. It’s just our normal, natural, way of being. We can’t help it. Like many seniors (I’m 69 and Gloria’s 59) and “retirees” we wanted to scale down and simplify. Living in “luxury” was never in our DNA.

Six or seven years ago, we were more frugal and cautious about our spending, but today we are likely to buy more freely and just flip the item in our shopping cart. Luckily, Gloria and I are on the same page about money. We both tend to be frugal. It’s just our normal, natural, way of being. We can’t help it. Like many seniors (I’m 69 and Gloria’s 59) and “retirees” we wanted to scale down and simplify. Living in “luxury” was never in our DNA.

We know, for many, the cost of living is the most important consideration regarding living abroad, but for us, even with only a small Social Security check of $922 in 2009, it was not. Therefore, inflation never figured into the math. I guess if inflation returned to the pre-2009 levels, it might be a major consideration, but so far, so good. We’re permanent residents and plan to stay in our adopted country, but we still intend to keep our options open.

So What Would It Cost YOU to Live in Costa Rica?

So What Would It Cost YOU to Live in Costa Rica?

Updated 06/08/2016

Well, the realistic and safe answer is, “it all depends on you, on your lifestyle and how you want to live.” People have asked us the question, “Can we live on $3,000-$4,000 per month?” In response, Gloria and I look at each other, chuckle, and say, “Of course you can.”

Well, the realistic and safe answer is, “it all depends on you, on your lifestyle and how you want to live.” People have asked us the question, “Can we live on $3,000-$4,000 per month?” In response, Gloria and I look at each other, chuckle, and say, “Of course you can.”

Again, it all depends on how you choose to live. We manage to save over 40% of our U.S. monthly budget and we think we live pretty well. If we followed more of our own tips, we could possibly further reduce our expenditures. Our goal is to live on less than $2,000 per month, and that has been achievable, though we admit, it’s getting harder.

But if you want to live in an expensive home (either a rental or to purchase) and shop exclusively in the “American” stores (Auto Mercado and PriceSmart), it can actually cost you more than in the U.S. If you purchase an expensive car and are looking to live in luxury, then that $3,000 target may not be achievable.

First, let’s look at our previous “big three” monthly expenses:

- Healthcare was over $1,000, now $215/month

- Rent or mortgage was $1260, now $500/month

- Heat and air-conditioning was $250, now $0/month, with an average electric bill of $49/month

Other areas of savings for us include:

- Groceries

- Eating out

- Telephone

- Car insurance

- Transportation

- Clothing

- Entertainment

- Pet care

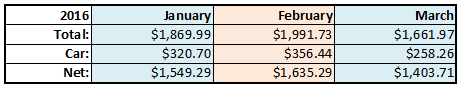

Look at our budget totals for the first three months of 2016. You can see that our car expenses are a big chunk of our monthly living expenses. If you choose not to buy a car, and take public transportation instead, think about how much you could save.

Often people will say they wouldn’t want to do that, you HAVE to have a car. It’s just not true. I know more than a few people who don’t have cars. It simplifies their lives greatly and saves them money. They walk, take buses and taxis. It’s the one thing you can do to easily simplify your life and cut expenses. Granted, without a car, you will be limited to some degree. But remember, without a car, you’ll do less, ergo spend less. You can always try going without a car for six months and buy a car later if you so desire.

Another way to keep your budget down is to rent a house or apartment for $300-$700 per month. An expat couple we know moved into in a small two bedroom apartment in town. It’s unfurnished, clean but cute, and they are paying $300/month rent, plus utilities. Since they live right in the town of San Ramon, and don’t own a car, their transportation costs are about $20/month. They walk a lot, take buses and taxis. Living in town, they are also immersed in the culture, have a lot of Tico friends, and speak a lot of Spanish which helps them to learn the language. They may not have that big view that we expats like, but everything’s a trade-off.

It’s not just about saving money. It’s that fact that when you own less, and need less, life is more simple and stress free. It’s all about your choices.

Related Articles:

- Paul’s Monthly Tip to Live for Less in Costa Rica: Don’t Buy a Car

- Paul’s Monthly Tip to Live for Less in Costa Rica: Taking the Bus

- Why We Chose Costa Rica

- Our Retire for Less in Costa Rica Philosophy

- Less is More

- Raising Your Standard of Living

- Simplicity – What is It?

The Best Way to Live for Less in Costa Rica (or Anywhere)

by Rob Evans

(Originally published 1/20/2015)

Recently, Greg Seymour gave me a great insight into living in Costa Rica. We were talking about expats’ obsession with the cost of living analysis, and Greg mentioned the best money saving idea he discovered was not to spend money. What? It took a little while to sink in, but eventually it made so much sense. Greg explained that without the convenience of a car or stores, he had less opportunity to spend money. Many of the articles about the cost of living in Costa Rica center on how much less is typically spent on healthcare, certain food items, and property tax. The cost analysis approach assumes expats are going to live the same lifestyle after moving to Costa Rica. So the cost of living articles line up the cost of eggs, a car, gas, etc. in Costa Rica and compare the unit price to the US price to demonstrate that living in Costa Rica is cheaper.

Recently, Greg Seymour gave me a great insight into living in Costa Rica. We were talking about expats’ obsession with the cost of living analysis, and Greg mentioned the best money saving idea he discovered was not to spend money. What? It took a little while to sink in, but eventually it made so much sense. Greg explained that without the convenience of a car or stores, he had less opportunity to spend money. Many of the articles about the cost of living in Costa Rica center on how much less is typically spent on healthcare, certain food items, and property tax. The cost analysis approach assumes expats are going to live the same lifestyle after moving to Costa Rica. So the cost of living articles line up the cost of eggs, a car, gas, etc. in Costa Rica and compare the unit price to the US price to demonstrate that living in Costa Rica is cheaper.

What Greg was telling me was the least expensive strategy was NOT to spend the money in the first place, which turned the cost of living discussion on its head. It is not the cost of the items, it’s the change in lifestyle: when you don’t have a car and you rely on the bus, you don’t need to worry about the cost of gas, insurance, or inspection. If you rent, you don’t need to worry about property taxes, home insurance, or alarm costs. If you can only get to the store once a week, there is no pizza delivery, and Amazon cannot find your home, you limit the opportunity for instant gratification and impulse buying.

I mentioned to Greg that, in the States, we would go to the grocery store for food many times a week; to the drugstore for batteries, paper, ointments; and to a department store for storage needs to hold all the stuff we bought. At the end of the month, we would always be a few hundred dollars over budget from frequent less- than-$10 charges buying “stuff we needed.” And when we started to move and began purging stuff and found all the pens, poster board, ointments, nail clippers, plastic crates, screws, picture hangers, poster board, expired super glues, and batteries that have accumulated over time, it finally hits me how much I spent (wasted) in small purchases over time.

Greg helped me see that if you cannot satisfy your consumer desires easily because you rely on a bus, you will find an alternative or you will realize you really don’t need it. For example, we often came home tired from work and would order a high-cost, high-calorie pizza; but now, living where we do in Costa Rica, going to get one (no bus after 4) or having one delivered are not options, which “saves” us $15 or more per week. Not being able to get to the hardware store or the storage store has “saved” us $20 per week. It is amazing how those “savings” add up over a month from just not spending the money in the first place.

Saving money by not spending it in the first place is something everyone could do in the US, but being habituated to the convenience of a car, multiple 7/24 stores, Amazon next-day delivery, and a consumer climate is hard to shake—it’s like trying to get off drugs while living in a crack house. Moving to Costa Rica can be like going into rehab.One day, Amazon drones may find me and offer to deliver, but not now.

Saving money by not spending it in the first place is something everyone could do in the US, but being habituated to the convenience of a car, multiple 7/24 stores, Amazon next-day delivery, and a consumer climate is hard to shake—it’s like trying to get off drugs while living in a crack house. Moving to Costa Rica can be like going into rehab.One day, Amazon drones may find me and offer to deliver, but not now.

When my father helped me open my first checking account, he told me the goal was to use up the deposit slip before the checks. Living here without a car and with limited access to impulse buying options has helped us achieve that goal of depositing more often than withdrawing. And we have discovered the best way to save money is not to spend it in the first place. Thanks Greg for the insight.

Bio: Rob and Jeni Evans moved to San Ramon from Raleigh, NC, in November 2014 after three years of unloading all they owed. Rob worked for IBM for 32 years and Jeni was an English teacher who homeschooled their children. Their goal now is to live fully and to see as much of Costa Rica as walking, buses, and taxis allow.

Related Articles:

- Paul’s Monthly Tip to Live for Less in Costa Rica: Don’t Buy a Car

- Paul’s Monthly Tip to Live for Less in Costa Rica: Taking the Bus

- Paul’s Monthly Tip to Live for Less in Costa Rica: Buy Just What You Need

A Single Woman’s Budget in Costa Rica: How She Lives on $1260 USD

(Originally published 2/23/16)

Debbie Rudd is a facebook friend and author of the new book, Costa Rica Where the Ordinary is Extraordinary: Loving the people and culture of Costa Rica. (Stay tuned for my review of her book in an upcoming newsletter.)

I admire Debbie Rudd. She is a good example of the possibilities of what life can be like for a single woman in Costa Rica. She speaks Spanish, doesn’t have a car, and lives on a smaller budget that we do. And she was nice enough to share her budget for the month of January. You can tell a lot about her life by the way she spends her money and time.

Debbie’s total monthly income is $1276.87 (USD):

- Social Security: $160.00

- PERA (Teacher Retirement): $1,116.87

Here’s Debbie’s budget breakdown for January totaling $1259.82 (USD):

- Personal Expenses:

- Rent (3BR, 1 Bath, Tico house): $400.00

- Electric: $23.54

- Water: $10.01

- Internet: $23.63

- No TV: $0

- (Our Spanish class was on a break all month but would normally be $40-not included here in total!)

- Cell phone recharge: $9.29

- Taxi/Gas for friend: $8.64

- No Car (use free bus pass for residents over 65 daily!): $0

- Food, Toiletries, paper products, etc.: $218.05

- Dog food for two dogs: $30.00

- PO Box rental for year: $27.86

- Caja through ARCR: $86.00

- Other Medical (pills I don’t get through Caja): $25.07

- Eating out: $27.91

- Clothes: $39.37

- Misc (paint, brushes, etc): $11.50

- Repairs: $27.86

- Donations for the Homeless

- Food

- Shoes

- Medical Supplies

- School supplies, backpacks- for the poor/homeless

- Other Expenses – $89.50

Thanks Debbie, for sharing your budget with our readers.

![]()

Why the Higher Cost of Living in Costa Rica Is Worth It

by Tammy (Originally published by Viva Tropical. Used with permission.) Photos, links, and notes by RFLCR.

Costa Rica has been an increasingly popular destination among tourists and expats for several decades. And, while it stands out heads above the rest for its abundance of untamed nature and the healthy lifestyle it offers, cost of living in Costa Rica is not among its biggest selling points.

Costa Rica has been an increasingly popular destination among tourists and expats for several decades. And, while it stands out heads above the rest for its abundance of untamed nature and the healthy lifestyle it offers, cost of living in Costa Rica is not among its biggest selling points.

While still considerably cheaper than the cost to live a vacation-worthy lifestyle in a comparable North American city (as if there were any that could hold a candle to Costa Rica), the cost of living in Costa Rica is actually among the highest in Latin America. It’s also THE highest in Central America. Yet the number of tourists it draws each year and the hordes of expats who’ve chosen to call it home have hardly dwindled despite the rising costs.

Let’s dig a little bit deeper into what’s really driving the cost of living in Costa Rica and why so many North Americans still think it’s totally worth it.

So, just how much higher is the cost of living in Costa Rica?

Like any other factor, the cost of living in Costa Rica can vary drastically from one area to the next. It also depends entirely on your lifestyle. Live in some relatively unknown place that’s off the beaten path with few amenities and poor  infrastructure and you can get by on $1500 or less per month for a family of two. On the other hand, if you decide to make your home in a newly renovated high-rise condo in the Central Valley where you dine out every night and shop to your heart’s content, you could easily need double or even triple that amount of money to live. But let’s talk in generalities for a moment. The Economist publishes a study called The Big Mac Index, named for McDonald’s large greasy burger. It compares the purchasing power of different currencies by comparing the cost of like items (i.e. the Big Mac) among countries to see how over- or under-valued their money is. In January 2014, the average price of a U.S. Big Mac was $4.62. In Costa Rica it was $4.28. To reference a few other Latin American nations, Mexico was $2.78, Colombia $4.34, Peru $3.56, and Venezuela a whopping $7.15. (No other Central American countries made the study.)

infrastructure and you can get by on $1500 or less per month for a family of two. On the other hand, if you decide to make your home in a newly renovated high-rise condo in the Central Valley where you dine out every night and shop to your heart’s content, you could easily need double or even triple that amount of money to live. But let’s talk in generalities for a moment. The Economist publishes a study called The Big Mac Index, named for McDonald’s large greasy burger. It compares the purchasing power of different currencies by comparing the cost of like items (i.e. the Big Mac) among countries to see how over- or under-valued their money is. In January 2014, the average price of a U.S. Big Mac was $4.62. In Costa Rica it was $4.28. To reference a few other Latin American nations, Mexico was $2.78, Colombia $4.34, Peru $3.56, and Venezuela a whopping $7.15. (No other Central American countries made the study.)

Not everything is more expensive in Costa Rica.

While this index gives a decent baseline for comparing prices, it’s far from being the definitive word on the cost of living in third-world countries. Sure, a Big Mac might rival U.S. prices, but there are a number of things that still cost considerably less in Costa Rica.

For example, due to the inexpensive cost of labor, many services can be had for a very reasonable price tag. Domestic help, like a maid or cook, can start as low as $3 per hour. A haircut will only set you back $3 or $4. Even the labor for auto repairs comes at an inexpensive rate. It’s the parts that will set you back a pretty penny. Education in Costa Rica is affordable as is the country’s health care (even at private facilities), which is of the highest quality. Property taxes are also low.

For example, due to the inexpensive cost of labor, many services can be had for a very reasonable price tag. Domestic help, like a maid or cook, can start as low as $3 per hour. A haircut will only set you back $3 or $4. Even the labor for auto repairs comes at an inexpensive rate. It’s the parts that will set you back a pretty penny. Education in Costa Rica is affordable as is the country’s health care (even at private facilities), which is of the highest quality. Property taxes are also low.

There are also a number of things that generally run about the same as their North American counterparts. Expenses in this category include utilities and services such as internet, cable, cell phone plans, water, and electricity. You can expect to pay about the same for these as you would in the U.S. although, depending on your location,you may have no need for heating and/or air conditioning expenses. Housing is also relatively inexpensive, with nice-size well-appointed accommodations ranging from $500 to $1500 per month.

However, as with all the above, it’s important to consider what you’re comparing these costs to. While much less on average than in the U.S., Canada, or Europe, individual budget items in Costa Rica can run significantly higher than in the rest of Central America.

What are Costa Rica’s big budget busters?

To answer this question, it’s important to consider a few important factors about the country. First of all, Costa Rica is a small country that must import a large number of the items people use for daily living. Add up the cost to get the items brought over plus the hefty import taxes the government loves to tack on, and things like automobiles and appliances can become incredibly expensive. On a smaller scale, the same is true for everyday items like imported wines or brand name peanut butter. So, to save considerably on your household expenditures, avoid anything imported. The country’s r elatively high utility costs are another big contributor to the higher cost of living in Costa Rica. They’re due to the monopoly held by government-run ICE (Instituto Costarricense de Electricidad, or the Costa Rican Institute of Electricity). Phone charges are based on usage, so you’ll pay depending on the amount of talking you do. Any vehicles brought into the country carry an extremely high import tax. Car tags are quite pricey as well. Gas in Costa Rica is also expensive, generally $1 to $2 more per gallon than in the U.S., which adds even more to the cost of owning a vehicle in Costa Rica. The poor driving conditions on Costa Rica’s subpar roads create additional wear and tear on vehicles, which creates the need for frequent mechanical work. In short, if you’re budget-conscious, don’t try to own a vehicle in Costa Rica. Public transportation is a much more affordable option.

elatively high utility costs are another big contributor to the higher cost of living in Costa Rica. They’re due to the monopoly held by government-run ICE (Instituto Costarricense de Electricidad, or the Costa Rican Institute of Electricity). Phone charges are based on usage, so you’ll pay depending on the amount of talking you do. Any vehicles brought into the country carry an extremely high import tax. Car tags are quite pricey as well. Gas in Costa Rica is also expensive, generally $1 to $2 more per gallon than in the U.S., which adds even more to the cost of owning a vehicle in Costa Rica. The poor driving conditions on Costa Rica’s subpar roads create additional wear and tear on vehicles, which creates the need for frequent mechanical work. In short, if you’re budget-conscious, don’t try to own a vehicle in Costa Rica. Public transportation is a much more affordable option.

What about food costs in Costa Rica?

This category also varies quite a bit depending on what and where you eat. Dining out, as evidenced by the Big Mac study,  can get expensive fast. That is, unless you dine at “sodas,” which are small, locally-run eating establishments. You can eat at local restaurants for $2 to $4 per person instead of the $15 to $20 you could expect to pay for a nice restaurant or chain franchise.

can get expensive fast. That is, unless you dine at “sodas,” which are small, locally-run eating establishments. You can eat at local restaurants for $2 to $4 per person instead of the $15 to $20 you could expect to pay for a nice restaurant or chain franchise.

If you like to cook, your best bet is to shop at local markets or do business with street vendors. You can choose from a great variety of locally-grown produce, beans, rice, and meat for a fraction of what you’d pay at the big box supermarkets, which closely resemble and even trace their roots back to some well-known U.S. chains. At the local street fairs you can buy big bunches of bananas for $.40 and large pineapples for only $1. You can also get freshly baked bread much cheaper (around $1.25 for a large loaf) from the local bakeries. On average, you can save about 30% on your grocery bill by avoiding the supermarkets. {RFLCR NOTE: that’s about what we save on our grocery bill.) You might expect great deals on fish and other seafood, but even these can get a little pricey, especially the further you get from the coast. Your best bet here is to make the occasional trip to the coastal areas to stock up at lower prices.

Why pay more to live in Costa Rica?

That’s an easy question to answer. And, no, we’re not going to say that you get what you pay for. Although you do. The fact is that putting the cost of living in Costa Rica up against other Central American countries is hardly an apples to apples comparison. Sure you can find cheaper places to live, some even awfully close by. But Costa Rica offers so much more.

That’s an easy question to answer. And, no, we’re not going to say that you get what you pay for. Although you do. The fact is that putting the cost of living in Costa Rica up against other Central American countries is hardly an apples to apples comparison. Sure you can find cheaper places to live, some even awfully close by. But Costa Rica offers so much more.

In Costa Rica, you get a well-educated strong middle class population who are friendly and welcoming to outsiders. You get low crime and political stability. And, dare we forget to mention, you get one of the most amazingly beautiful settings on the entire planet. Most importantly, though, you get choices. With so many options available, in terms of housing, consumer goods, and services and amenities, you can pick and choose what’s important to you in Costa Rica. If you want to live, eat, and dress like a local so you can save up most of your dollars for travel throughout the region, you can totally do that. If you’d rather live like a king in the big city so that you never have any desire to go anywhere else, then that’s also an option.

So if this top expat destination is on your short list of countries you’re considering, don’t let the marginally higher cost of living in Costa Rica dissuade you.

Related Articles:

- The Economist’s Big Mac Index

- Paul’s Monthly Tip to Live for Less in Costa Rica: Hair Today, Gone Tomorrow

- Paul’s Monthly Tip to Live for Less in Costa Rica: Save on Car Repairs

- Paul’s Monthly Tip to Live for Less in Costa Rica: Save Thousands on Private Medical Care

- Paul’s Monthly Tip to Live for Less in Costa Rica: Save on Telephone Service

- Paul’s Monthly Tip to Live for Less in Costa Rica: Live Where You Don’t Need Heat or Air-Conditioning

- Paul’s Monthly Tip to Live for Less in Costa Rica: $1 Lunch at the Central Market

- Paul’s Monthly Tip to Live for Less in Costa Rica: Buy Local

- Paul’s Monthly Tip to Live for Less in Costa Rica: Eat Less Meat and More Fruits and Vegetables

- Another Reason We Chose Costa Rica – the People

When, How, and What People Spend in the U.S.A.

US cost of living broken down by age

I recently saw this graphic when I logged on to my Bank of America account online and thought it would be interesting when comparing the typical U.S. household cost of living to our COL in Costa Rica, and maybe yours as well. We’d love your feedback on how your Costa Rica or USA cost of living compares:

There were additional categories included in the graphic, including:

- Monthly Education Budget

- Monthly Entertainment Budget

- Monthly Pension and Personal Insurance Budget

To see the graphic in it’s entirety, visit this link. The stated source is the 2013 United States Bureau of Labor Statistics.

![]()

Our Ultimate CR Healthcare Tour: Announcing a Special Tour with Focus on Cancer Treatments in Costa Rica

We are proud to offer the Ultimate Healthcare Tour of Costa Rica. When asked what he liked best about our healthcare tour, one of our guests wrote, “the wide variety of places we saw, the experts that Paul  arranged for us to meet and talk with, and an emphasis on all aspects of health, not just doctors and hospitals. Mental health is just as important as physical, if not more so.”

arranged for us to meet and talk with, and an emphasis on all aspects of health, not just doctors and hospitals. Mental health is just as important as physical, if not more so.”

We’ve lived in Costa Rica for over seven years and have used the Caja, Costa Rica’s public healthcare system extensively, as well as the private system, when needed. We’ve learned the system and have been referred up the ladder to see specialists in the maze that is the Caja system. Gloria’s even had surgery here.

Our blend of personal insights and on-the-ground experience combines to answer your questions about whether or not Costa Rica’s healthcare system could meet your individual needs.

But, while it is focused on healthcare, you will learn a lot more about living and retiring in Costa Rica’s Central Valley. Most of the second day of the tour takes place in the town of San Ramón where we live and use the services. And you will come to our home for lunch that day to listen to two of our featured speakers.

Our tour is designed to save you both time and money, packing a lot of information into a short period of time. Our goal is to show you the possibilities and to try to demystify Costa Rica’s healthcare system. Our tour lasts two days and 1 night and includes lodging, transportation, meals and non-alcoholic beverages.

Sample Itinerary

You’ll visit:

- At least two private hospitals in San Jose area

- Hospital Mexico, the largest and best public hospital (they even do open heart surgeries there)

- An insurance broker for a presentation on the various supplemental health insurance options, including public, private, and international plans

- A senior living retirement community

- CPI language school for a presentation about how learning Spanish increases your options for healthcare and some basic medical Spanish.

- Our local hospital here in San Ramón

- A local EBAIS (community clinic)

- A local private medical and dental clinic

- A local Seguro Social office where you would sign up for the Caja (national healthcare coverage)

- A pharmacy

- A local feria (farmer’s market) where you will see the abundance of fresh food available.

- The local Cruz Roja (Red Cross) to learn about their services and programs.

- A health food store (macrobiotica), and more!

You’ll learn:

- If the Costa Rican healthcare system could meet your needs and put your mind to rest, once and for all, about this sensitive subject.

- About the public system and how it works, about the private healthcare system, and how you can use a combination of both to your advantage.

- About the EBAIS – where healthcare starts in Costa Rica.

- Approximately how much you would pay for Caja.

- About medical tourism in Costa Rica.

- About home health care in Costa Rica.

Introductory prices: $550 for a couple, $450 for a single.

Please contact us if you are interested in booking this tour. Space is limited.

Related Articles:

- Paul Gets a CAT Scan Through the Caja

- Integration 102 – Speaking Up at the Hospital

- Waiting to See the Doctor, by Jo Stuart

Facebook, Twitter, & YouTube

Facebook, Twitter, & YouTube

![]()

![]()

![]() You can now follow us on Facebook and Twitter, so please “like” us on Facebook, “follow” us on Twitter, and watch and share our videos on YouTube.

You can now follow us on Facebook and Twitter, so please “like” us on Facebook, “follow” us on Twitter, and watch and share our videos on YouTube.

What’s New on the Website

What’s New on the Website

Check out our newest posts on www.retireforlessincostarica.com:

- Costa Rica Weather–April 2016 Observations, Facts, & Tidbits

- Our April 2016 Costa Rica Cost of Living Expenses-$2,260.63

- Singing and Dancing in New Orleans: Our April 2016 Vacation

- The Yearly Invasion of the Abejones

- Significant Earthquakes in Costa Rica Over the Last 100 Years

- Costa Rica Weather Report: 2016 Monthly Temps & Rainfall

- Costa Rica Weather: Our 2016 Weatherguys and Weathergals