Cost of Living

Our Costa Rica Cost of Living, by Rob Evans

- By in Blog

![]()

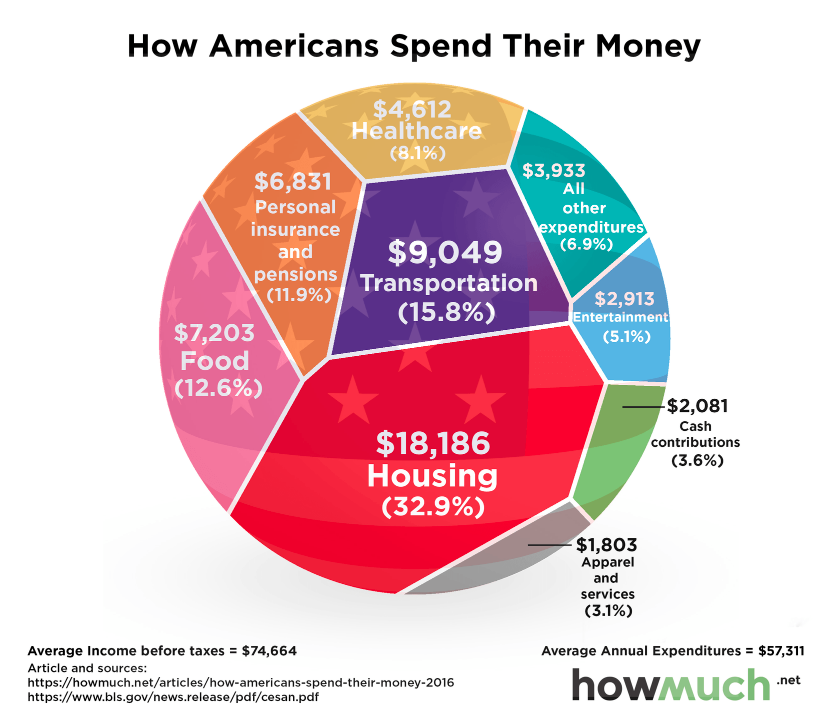

The Bureau of Labor Statistics’ annual report on consumer expenditures shows the “average” American household (AAHh) spent $57,311 in 2016. Note, $74,664 is the “average” income and $57,311 is the average spent after taxes.

The Bureau of Labor Statistics’ annual report on consumer expenditures shows the “average” American household (AAHh) spent $57,311 in 2016. Note, $74,664 is the “average” income and $57,311 is the average spent after taxes.

I decided to compare the expense published against what I spend in Costa Rica, but I see a problem with this right up front—undefined variables. For example, what is a “average” and what is “household”? A typical US household could include singles, married without children, married with many children, etc. And the “average” income is usually the “median” income since billionaires skew the income much higher than people could relate to. Furthermore, these averages are primarily for people still in the workforce, while my expenses are for a retired couple (50’s). So for the statisticians, I am afraid my comparison is not precise.

Still, the question of cost of living comes up frequently as working Americans nearing retirement wonder if they can afford to move to Costa Rica. On the forums, questions about cost of living receive answers ranging from $600 to $10,000 a month depending on whether the person answering is single or has a family, owns a home, lives on the beach, has a pool, uses AC, drinks alcohol, or owns multiple cars. Again, my answer is for a retired couple with no dependents, no car, no pets, and no pool, not living at the beach.

Comparison

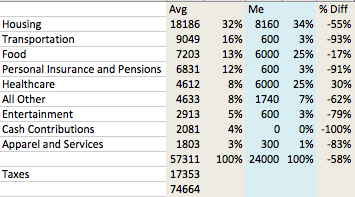

Here is a side-by-side comparison of the published data and my costs. I spend about $2000 a month, which comes from my pension. I included the published average in the first column, the percent of the total in the second, my numbers in the third and fourth, and the percent difference in the last column. So, let’s explore each line item.

Housing

I rent a furnished, 2-bed, 1-bath home in the capital of San Jose. It is a convenient two-story, older apartment with lovely terraces and great security. The rent is $600, which includes water. We spent $700 a month in San Ramón all-inclusive so I know this amount of rent is not unusual. The electricity is about $50 a month and Internet is $30 (5Mb). We have a maid come by occasionally for $20, which is a common small luxury. You might see bigger numbers for electricity from some CR expats who have pools and rely on AC. The temperature in San Jose is a comfortable 75°F +/- 10 degrees, so we leave the windows open year-round. As a result, I spend 55% less than the average American household (AAHh). Again, be aware: many people will tell you their housing is $200 a month forgetting to mention they bought their home for $200k and have no mortgage or they rent unfurnished places (meaning they bought the stove/refrigerator, etc.).

I rent a furnished, 2-bed, 1-bath home in the capital of San Jose. It is a convenient two-story, older apartment with lovely terraces and great security. The rent is $600, which includes water. We spent $700 a month in San Ramón all-inclusive so I know this amount of rent is not unusual. The electricity is about $50 a month and Internet is $30 (5Mb). We have a maid come by occasionally for $20, which is a common small luxury. You might see bigger numbers for electricity from some CR expats who have pools and rely on AC. The temperature in San Jose is a comfortable 75°F +/- 10 degrees, so we leave the windows open year-round. As a result, I spend 55% less than the average American household (AAHh). Again, be aware: many people will tell you their housing is $200 a month forgetting to mention they bought their home for $200k and have no mortgage or they rent unfurnished places (meaning they bought the stove/refrigerator, etc.).

Transportation

I spend 93% less on transportation than the AAHh primarily because I do not own a car but walk and use the bus or Uber. One of the reasons I moved to CR was to lower my stress. I felt car ownership would cost more and cause more stress than it was worth. One benefit of walking was I lost 70 pounds. Again, note: what can be confusing about this category is that people will leave out the purchase price and depreciation costs for their car. They might include the gas, oil, taxes and maintenance, but leave out the $25k they spent to buy the car and the $2000 a year in depreciation as the car gets older.

Food

I spend 17% less on food than the AAHh. That is not a big difference and surprised me. This category includes both eating in and eating out. One difference is that the AAHh spends 40% of their budget eating out while I eat out infrequently. I have never worried much about our food budget but have concentrated more on making sure our food was healthy. I spend more on extravagances like salmon, which I think is good for us and spend less eating out. Again, note: since I am retired, I can spend more time shopping, preparing and cooking food than the AAHh who might need to pick up prepared food on the way home from work. Also, I drink very little alcohol, which can be a large “food budget” item for some.

Personal Insurance and Pension

I am not fully sure I understand all that is included in this category. As a retiree, I am not saving for retirement, so that is zero. For personal insurance, I spend $50/month for life insurance. I bought $100k term policy until I am 70 in the event I die before we collect Social Security. That should allow my wife to have the choice between staying in Costa Rica or moving back to the US. I do not have renters’ insurance.

Healthcare

Here’s a shocker. I spend 30% more than the AAHh. I broke down my healthcare costs in my previous article:

I spend about $300 a month on insurance and another $200 for deductible, tests, drugs, etc. or about $500 a month for two 60-year-old adults.

What you have to watch out for in this category are 1) number of people in the family; and 2) the actual cost and 3) flexibility.

I think the REAL cost of healthcare insurance in the US is about $500 per person per month for someone my age. So, $500 x 2 people x 12 months or $12k/yr. That is about what Medicare advertises for people who want Medicare but are not eligible from their work history. So, for comparison, it would cost me $500 x 2 people or $1000/month or $12,000/year for health insurance, which is one of the main reasons I needed to leave the US.

In addition, Americans have the cost of deductibles, co-payments, etc. that add more cost. Also, most Americans do not pay the actual bill. Employers often pay a portion of the employee’s health insurance up to the entire bill. I often hear people who pay nothing for health insurance confused on why people are complaining about the cost. In general, US employers pay 1/3 of the health insurance bill for employees. Once you leave the government or corporate world, you may be shocked to learn the ACTUAL cost. I suspect that the ACTUAL cost for the AAHh (employee + employer) is higher than reported with a supplement paid by the employer.

Finally, instead of health care, the US has pain management care—in other words, much of US healthcare cost is directed to fixing preventable problems. A subtle difference between the AAHh costs and my costs is that I try to direct resources to prevention and early detection. My priority is to stay out the hospital by investing in good nutrition, exercise, and preventive tests. When you pay your own way, you have that flexibility.

Entertainment

I spend 79% less on entertainment than the AAHh. Many Americans buy expensive cable TV packages, go to the movies, and attend professional and college sports. My needs are much simpler and I only have $8/month Netflix (one user / low definition) and go to the museum, buy a book, attend the theater and take in a movie infrequently. I want to note my income is higher than my expenses and I use that money for travel when ever the stock market is on the rise and stay home when it is not.

Cash Contribution

Cash contribution is primarily religious and political giving. Because of the election last year, political giving was way up. I left it zero because I think the amount is a personal matter.

Apparel and Services

I spend 83% less on this category than the AAHh. Since the weather is perfect in Costa Rica, there is no need for an abundance of clothing. In fact, we gave away all our winter clothes when we left the US. We even left a couple of final items in the hotel before our flight. I kept a sweater for when it gets down to 65°F. As for services, I guess they are referring to things like dry cleaning, duct cleaning, landscaping, gutter cleaning, etc., which do not pertain to me anymore. If they are referring to haircuts, those cost very little.

Conclusion

I hope this helps clarify the Cost of Living in Costa Rica question. It is a very important question for Americans trying to understand if they can retire in CR.