Cost of Living, Life in CR

Retire for Less in Costa Rica – September 11, 2016

Welcome to our Retire For Less In Costa Rica Newsletter

In This Issue:

- Our August 2016 Costa Rica Cost of Living

- Our Costa Rica Food Budget Breakdown (Updated 9/6/16)

- Invest Your Savings in Coopenae (Updated 9/10/16)

- Featured Property-Lake Arenal: Comfortable 3BR Furnished Lakeview Home—Hot Deal! $150,000 (Reduced from $199K)

- Our Ultimate CR Healthcare Tour

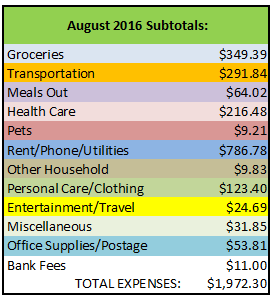

Our August 2016 Costa Rica Cost of Living

Our August 2016 Costa Rica Cost of Living

After our big 12-day road trip in July, it was nice to be back home and to have a more normal month of spending. But we have another big month ahead in October when we travel to Mexico for 30 days! And September is usually a big month because that is when we pay our twice-yearly car insurance premium as well as have our RITEVE (annual car inspection) done. But for August, there is not a lot to report, just a few interesting expenses and purchases.

After our big 12-day road trip in July, it was nice to be back home and to have a more normal month of spending. But we have another big month ahead in October when we travel to Mexico for 30 days! And September is usually a big month because that is when we pay our twice-yearly car insurance premium as well as have our RITEVE (annual car inspection) done. But for August, there is not a lot to report, just a few interesting expenses and purchases.

Groceries – $349.34

Groceries came in right at our 2015 monthly average, even with spending $50 at the Nutresol distributor in Grecia. There, we can buy kilo bags of shredded, dry coconut, almonds, cashews, and other nuts, as well as green pumpkin seeds (so hard to find here), sesame seeds, and sunflower seeds. We eat lots of nuts and seeds for protein and good fats, and I make homemade granola with them. Dried coconut goes in the homemade granola too; I also use it to make homemade coconut milk. (Last time I mentioned this, I got lots of request for the recipes, so this time I’ve added the links. Hope you enjoy them!)

Transportation – $291.84

Other than gas and tolls, our only other car-related expense was 70,000 colones (about $128.00) for a bit of body work on our car. While backing up our long, hilly driveway one morning, Paul clipped a tree and dented the passenger’s side bumper, knocking out the blinker light but not breaking it. (In the two fender-benders Paul has had while living in Costa Rica, he’s only hit things, not people!) He took it to Manuel who does body work locally and he only charged 70,000 colones to fix and paint it. In the States, this would have been at least $400.

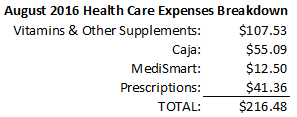

Healthcare – $216.48

Now that we are spending more of our healthcare dollars on vitamins and other natural supplements, I thought I would break out our monthly spending for August:

The $12.50 for MediSmart is the yearly total pro-rated over 12 months. Take a look at our article for all the details.

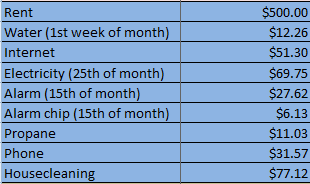

Rent, Phone, & Utilities – $786.78

Our electricity bill of just under $70 is a little higher than our bills in the dry season. The reason is that we run our ceiling fans all the time and also use our dryer almost exclusively on laundry days during the rainy season.

Our housecleaning expense was a bit higher than normal as our housekeeper comes on Wednesdays, and there were five Wednesdays in the month of August. We also gave her a raise that took effect towards the end of August. Instead of paying her 8,000 colones ($14.71) for four hours work, we now are paying her 9,000 colones ($16.51). Note: when she started cleaning for us over two years ago, we started her at the going rate of 6,000 colones.

Personal Care & Clothing – $123.40

Haircuts, clothes, and a new electric shaver/trimmer for Paul ($31.68) for at-home beard trims.

Office Supplies & Postage – $53.81

The bulk of this category was spent on three new color ink toner cartridges for our Epson printer ($48.30). We also spent $3 to mail our absentee ballot request to Florida in order to vote in the U.S. election in November.

Bank Fees – $11.00

Okay, here’s a category where we normally do not have any charges. We write checks from our U.S. bank to our Costa Rica Cooperativo (credit union). That way we don’t have the high ATM charges whenever we need cash. It takes a month for the check to clear but usually we plan accordingly. We should have written a check before our 12-day road trip in July, but instead, we waited until we returned to write the check. Bad move. The check didn’t have enough time to clear before we needed cash to pay bills in August, so we needed to use ATMs to access our cash. Gee, I hate to pay bank fees, don’t you?

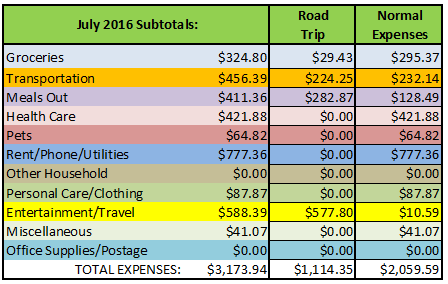

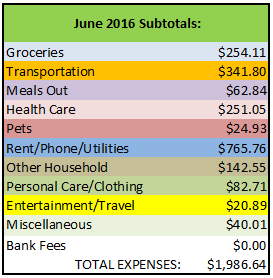

That’s it for August. As usual, to help put things into perspective, here are our expenses for the previous two months. If you want more information about a particular month, just click on the graphic for that month below:

Related Articles:

- Our 2015 Annual Cost of Living in Costa Rica Summary

- Our 2014 Annual Cost of Living in Costa Rica Summary

- Our 2013 Cost of Living Summary

- Our 2012 Cost of Living Summary

Our Costa Rica Food Budget Breakdown

Updated 9/6/2016

Since we recently published our 2015 Cost of Living Summary, it’s time to update our Costa Rica food budget breakdown. Following are our monthly averages for the last several years:

Since we recently published our 2015 Cost of Living Summary, it’s time to update our Costa Rica food budget breakdown. Following are our monthly averages for the last several years:

- 2015 groceries monthly average: $351.97*

- 2014 groceries monthly average: $301.00

- 2013 groceries monthly average: $379.81 (a 10% increase over the previous year)

- 2012 groceries monthly average: $345.96 (an 8% increase over the previous year)

- 2011 groceries monthly average: $319.09

Our 2015 monthly average for groceries was closer to what we spent in 2012, and about $25 less per month than in 2013. In 2014, we traveled for two months of the year so our grocery expenses were abnormally low. Our 2016 average for groceries will most likely be higher than 2015 as we have added coconut oil to our diet every day, and we try, when possible, to buy organic produce — difficult to do on a continuing basis in our town of San Ramón.

We still think we’re saving about $100/month over our U.S. grocery expenses, as prices have increased there as well. We manage to keep it close to $350 most months because we rarely go to the big box stores in Alajuela – Auto Mercado, PriceSmart, and Walmart. When we do go there, we have the tendency to buy in bulk, including some U.S. products which are imported to Costa Rica and can’t be found at our local stores in San Ramon. The imported products can cost two to three times what they would in the States due to the high import taxes, so we buy as little of these as possible.

We eat about the same as we did in the U.S. – lots of fruits and veggies, with meat usually only at the evening meal. Rather than breaking down the individual costs of every little item – broccoli, cauliflower, tomatoes, etc. — let’s just say it’s less, a lot less, in Costa Rica for fruits and veggies. One reason is that we are not buying things like bagged salads and frozen vegetables, instead buying fresh, local, and in-season. We’re so lucky here to have a year-round growing season for most things.

We eat about the same as we did in the U.S. – lots of fruits and veggies, with meat usually only at the evening meal. Rather than breaking down the individual costs of every little item – broccoli, cauliflower, tomatoes, etc. — let’s just say it’s less, a lot less, in Costa Rica for fruits and veggies. One reason is that we are not buying things like bagged salads and frozen vegetables, instead buying fresh, local, and in-season. We’re so lucky here to have a year-round growing season for most things.

Our Food Budget Breakdown

*So what does our 2015 average of $351.97 include? It includes almost everything – food, wine, and flowers, paper products (paper towels, toilet paper, wax paper, plastic wrap, and aluminum foil, zip lock bags, etc.), cleaning products (dish soap, laundry soap, Clorox, sponges, disinfectant, etc.), charcoal for the grill, and personal care products (bar soap, shampoo, razors, powder, etc.). All in all, not bad for $351.97.

As of January 2015, we started breaking out our non-food items from food items when we tally our monthly grocery spending. On average, for the year 2015, we spent about 84% on food items and 16% on non-food items as described above. So, breaking it out, in 2015 we spent an average of $296 for food and $56 for non-food items. A good goal is to decrease the percentage spending on non-food items. If you have any tips to do this, let us know and we’ll share them with our readers.

This category does not include cat food and litter, nor does it include eating out in restaurants. We have separate categories for those things and will break these, and other categories down, in future months. We eat great and we’re not suffering.

Related Articles:

- Our 2015 Annual Cost of Living in Costa Rica Summary

- So What Would It Cost ME to Live in Costa Rica?

- Paul’s Monthly Tip to Live for Less in Costa Rica: Buy Local

- Paul’s Monthly Tip to Live for Less in Costa Rica: Eat Less Meat and More Fruits and Vegetables

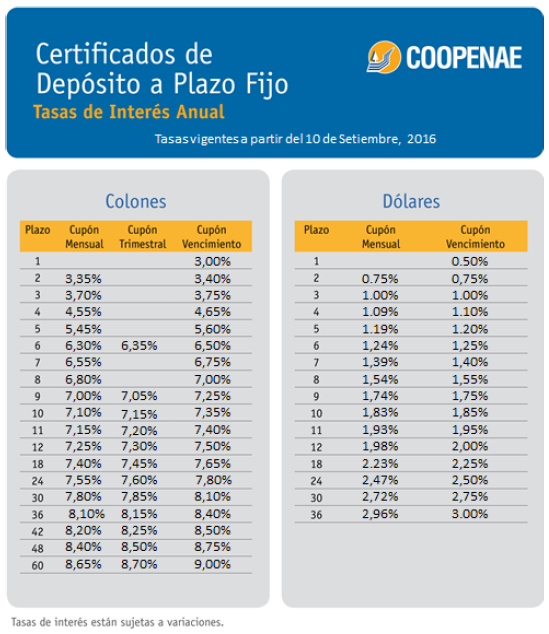

Invest Your Savings in Coopenae (Updated)

Updated September 10, 2016

Why invest in Coopenae?

- Audited by Fitch Ratings (auditor of banks worldwide) from which we got excellent ratings: expectation of very low risk; risk differs very little from the highest possible ratings (see below for details).

Extensively monitored and controlled, just like other public and private banks in Costa Rica, by SUGEF (General Superintendence of Financial Entities) and our overall rating is an outstanding 1.10, where 1.00 is the best possible.

Extensively monitored and controlled, just like other public and private banks in Costa Rica, by SUGEF (General Superintendence of Financial Entities) and our overall rating is an outstanding 1.10, where 1.00 is the best possible.- Audited by well-known international companies, last period, by Peat Marwick (KPMG Dec. 2015).

- Controlled by the internal audit of Coopenae, and watched by an independent Committee of Investors at every home Branch.

- Followed by the competition and valued by our Members.

Credit Portfolio:

Our loan portfolio is positioned mostly throughout the Government Sector, where we have automatic payroll deduction. Also, our performance in credit default on the loan portfolio late over more than 90 days in Dec. 2015 is only 0.88%, one of the lowest in the domestic financial market.

Excerpts from Fitch Ratings Report Regarding Coopenae – August 2016

Robust Equity: Capitalization is Coopenae’s main strength, with an indicator of Capital Base according to Fitch Ratings of 21.3% at March 2016. This level provides a good capacity to absorb losses. The indicator of capital of the company has been gradually reduced in terms of growth, albeit much slower than their peers in the credit union sector.

Portfolio impairment low: Coopenae maintains a good portfolio quality, based on appropriate risk administration and management structure with direct discount charges through payroll deduction. In March 2016, loans late over 90 days accounted for 0.9% of total loans (credit default rate), a level that is favorably compared to other credit unions qualified by the agency.

Good liquidity and term mismatching: The liquidity of the institution is good and is made mostly by local securities available for sale. These liquid assets cover about half of total deposits, exceeding the average level of their peers in the credit union sector.

The company ranks first in terms of assets with a market share of 24.3%. The franchise of the institution is strong within the credit union system. As for deposits, it holds first place with a share of 25.1%, which shows largest passive franchise in the sector.

The institution does not have goals related to maintaining market position, but instead favors a healthy sustaining of the institution’s performance. It is observed that they stay within their annual budgets.

Risk appetite: Moderate Risk appetite is favorable against peers in the credit union sector. The Coopenae risk appetite is moderate, this is reflected in its portfolio growth lower than that of their peers and more prudent loan volumes. This is demonstrated in the improved quality of assets of the credit union compared to its peers. The institution has remained true to its segment (government employees), of which it has a good knowledge. Recently, the institution made some adjustments in policies to become more restrictive, by observing an increased credit default rate in 2015 within the credit union system.

Increased Risk Appetite: On the other hand, an increase in the risk appetite of the institution, which affect the asset quality of the cooperative, would produce a negative impact on ratings.

The institution has appropriate risk controls for the level of complexity of business conducted by the cooperative. Coopenae invests in the installation of systems to allow better monitoring of the main risks of the operation. The company has gradually incorporated a better assessment of the payment capacity of debtors.

The growth of the cooperative has been more moderate compared to the cooperative system, although it is higher than the growth of the banking system. Coopenae’s portfolio has shown growth near 15%, while the cooperative system has had growth of about 20%.

Low exposure to market risks: The market risks to which the entity is exposed are low. It mitigates currency risk with low foreign currency balance. The short position is equivalent to 3.3% of equity, low and decreasing compared to previous years. Regarding the interest rate risk, Coopenae has the ability to adjust their rates to address potential increases in funding costs, since the portfolio is positioned at adjustable interest rates. However, the cooperative sector is sensitive to a rate hike because there could be delays in the transfer of the increase to the base of debtors, in order not to damage the credit quality and social objectives given to members.

Coopenae has shown a good portfolio quality through the years; this quality is based on proper risk management and collection management structure. In March 2016, loans late over 90 days accounted for 0.9% of the total. The institution is favorable compared to other qualified by the agency, who increased its deterioration recently. In this regard, the first signs of possible member over-indebtedness of the cooperative sector are already becoming visible, although Coopenae has been more cautious in its loan volumes in recent years and should better maintain a quality portfolio than its peers.

Favorably, the institution placed most of its portfolio in local currency, in contrast to the practice of the banking system highly exposed to the currency by high levels of dollarization of the portfolio.In March 2016, the profitability of the cooperative assets was 1.2%, still below the average of the cooperative system of 1.6%, but still comparing favorably against the average 0.9% of Costa Rican banking. The institution margins are lower than its main peers both portfolio composition, possessing a major component of mortgage loans, as well as having a more liquid balance.”

Service:

We feel an obligation to regularly inform our Members (current and potential) on our performance in order to have the possibility to follow up on the results that are obtained. That is why Coopenae is the largest Costa Rican supervised private financial company and the 3rd largest in Latin America.

Certificates of Deposit Rates for Investments in Colones and in U.S. Dollars:

Your first point of contact:

Asdrúbal Zamora

National Executive of Expats

Cell Phone (+506) 8811-1602

Corporate Email: azamora@asesorcoopenae.fi.cr

View and/or download Coopenae’s corporate presentation below:

Featured Property-Lake Arenal: Comfortable 3BR Furnished Lakeview Home—Hot Deal! $150,000 (Reduced from $199K)

3 Bedrooms

3 Bathrooms

Acreage: .5 acres (1963 m2)

Location: Rio Piedras

This charming 3 Bedroom, 3 Bath furnished home sits gracefully on a hillside overlooking Lake Arenal. You can see wind surfers and kite surfers from your very large front veranda while relaxing in your hammocks. You also have a beautiful view of the Continental Divide Mountains as background to the lake. We have fresh air from the forests behind with cool breezes from the East and excellent drinking water (the gold of the future) from local Artesian community wells. The average temperature year round is 74F with cool fresh breezes. The property has fruit-bearing trees of tangerines, avocado, lemons and bananas. You can see many colorful tropical birds and monkeys from this peaceful, private home.

There is a hot tub in a separate room next to the deck. A very large garage in the back of the house holds 3 cars, a separate secured, large storage room, and a laundry area. This garage is large enough to enclose for a separate entranced apartment for rental income, use as a guest room, or use for live-in help if necessary… it would be simple to convert.

The house under roof is 42 ft. long, the side facing the view, the other side is 55.6 ft. Part of that is garage which is 21.6 ft x 42 ft. The property is also already registered is in an S.A. (corporation) which can go with the property at no extra cost.

This beautifully landscaped property is fenced and has a tall hardwood electric gate and alarm system for unusually good security if away from home. The drive is only 15 minutes to the growing town of Nuevo Arenal, with its large expat community and always something to do if you wish to join, 20 minutes from Tilaran, and 1.5 hours on all paved roads to the Liberia international Airport.

Property: Ref # 171

Click here for more photos and to contact the realtor for this property.

Click here to check out our other properties under $150,000 and read about what to do before you buy.

![]()

Our Ultimate CR Healthcare Tour

We are proud to offer the Ultimate Healthcare Tour of Costa Rica. When asked what he liked best about our healthcare tour, one of our guests wrote, “the wide variety of places we saw, the experts that Paul  arranged for us to meet and talk with, and an emphasis on all aspects of health, not just doctors and hospitals. Mental health is just as important as physical, if not more so.”

arranged for us to meet and talk with, and an emphasis on all aspects of health, not just doctors and hospitals. Mental health is just as important as physical, if not more so.”

We’ve lived in Costa Rica for over seven years and have used the Caja, Costa Rica’s public healthcare system extensively, as well as the private system, when needed. We’ve learned the system and have been referred up the ladder to see specialists in the maze that is the Caja system. Gloria’s even had surgery here.

Our blend of personal insights and on-the-ground experience combines to answer your questions about whether or not Costa Rica’s healthcare system could meet your individual needs.

But, while it is focused on healthcare, you will learn a lot more about living and retiring in Costa Rica’s Central Valley. Most of the second day of the tour takes place in the town of San Ramón where we live and use the services. And you will come to our home for lunch that day to listen to two presentations.

Our tour is designed to save you both time and money, packing a lot of information into a short period of time. Our goal is to show you the possibilities and to try to demystify Costa Rica’s healthcare system. Our tour lasts two days and 1 night and includes lodging, transportation, meals and non-alcoholic beverages.

Sample Itinerary

You’ll visit:

- At least two private hospitals in San Jose area

- Hospital Mexico, the largest and best public hospital (they even do open heart surgeries there)

- An insurance broker for a presentation on the various supplemental health insurance options, including public, private, and international plans

- A senior living retirement community

- CPI language school for a presentation about how learning Spanish increases your options for healthcare and some basic medical Spanish.

- Our local hospital here in San Ramón

- A local EBAIS (community clinic)

- The office of our dentist in San Ramón

- A local Seguro Social office where you would sign up for the Caja (national healthcare coverage)

- A pharmacy

- A local feria (farmer’s market) where you will see the abundance of fresh food available.

- The local Cruz Roja (Red Cross) to learn about their services and programs.

- A health food store (macrobiotica), and more!

You’ll learn:

- If the Costa Rican healthcare system could meet your needs and put your mind to rest, once and for all, about this sensitive subject.

- About the public system and how it works, about the private healthcare system, and how you can use a combination of both to your advantage.

- About the EBAIS – where healthcare starts in Costa Rica.

- Approximately how much you would pay for Caja.

- About medical tourism in Costa Rica.

- About home health care in Costa Rica.

Prices: $650 for a couple, $550 for a single.

Please contact us if you are interested in booking a tour. Space is limited.

Related Articles:

- Paul Gets a CAT Scan Through the Caja

- Integration 102 – Speaking Up at the Hospital

- Waiting to See the Doctor, by Jo Stuart

Facebook, Twitter, & YouTube

Facebook, Twitter, & YouTube

![]()

![]()

![]() You can now follow us on Facebook and Twitter, so please “like” us on Facebook, “follow” us on Twitter, and watch and share our videos on YouTube.

You can now follow us on Facebook and Twitter, so please “like” us on Facebook, “follow” us on Twitter, and watch and share our videos on YouTube.

What’s New on the Website

What’s New on the Website

Check out our newest posts on www.retireforlessincostarica.com:

- Getting Married (Again) in Costa Rica

- Our July 2016 Costa Rica Cost of Living

- Our 12-Day Road Trip to Costa Rica’s Southern Zone: San Isidro de El General

- Our 12-Day Road Trip to Costa Rica’s Southern Zone: Drake Bay, Osa Peninsula

- Our 12-Day Road Trip to Costa Rica’s Southern Zone: San Vito

- Our 12-Day Road Trip to Costa Rica’s Southern Zone: Uvita & Quepos

- Cascata Del Bosco Bed & Breakfast Hotel – A Tranquil Place to Stay in San Vito

- Costa Rica Weather–June 2016 Observations, Facts, & Tidbits

- Costa Rica Weather Report: 2016 Monthly Temps & Rainfall

- An Affordable Alternative to Private Health Insurance in Costa Rica

- Our 2015 Annual Cost of Living in Costa Rica Summary